Consumers looking for more affordable options may not totally factor in the risks associated with natural disasters and the subsequent costs. While borrowers may end up spending more to cover damages, they also run the danger of

"When you buy a home you are paying for more than just the house," Daryl Fairweather, Redfin chief economist, said in a press release. "There could be hidden costs associated with natural disasters. If a natural disaster strikes, you may have to pay for damage to your home or for the cost of evacuating your family. And even during times of calm, you may still need to pay for insurance against floods, fire, or earthquakes. Some homes in more hazardous areas might seem more affordable if you are just looking at the sticker price, but they may end up costing more when risks related to natural disasters are factored in."

From Texas to the nation's capital, these are the 12 most hazard-prone housing markets.

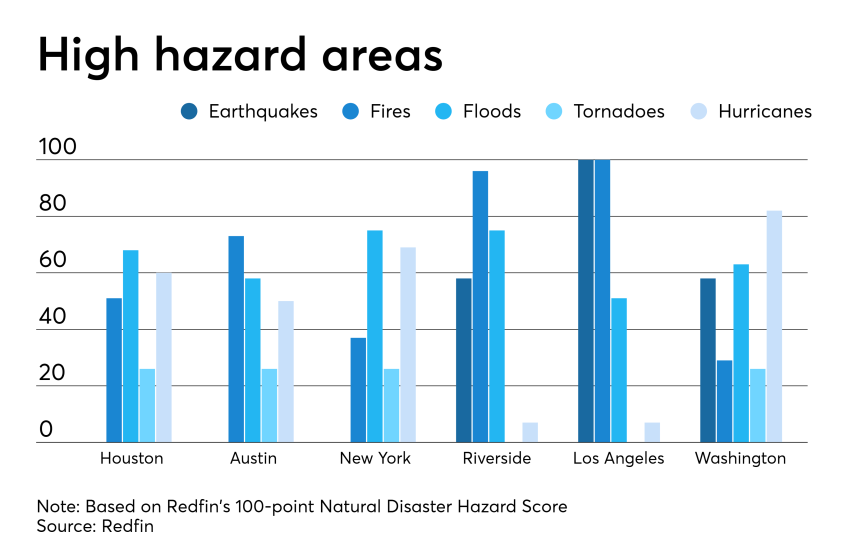

Redfin used February 2019 data and rated the 50 biggest metro areas according to their relative frequency of five major types of natural disasters — earthquakes, fires, floods, tornadoes, and hurricanes — using their new metric called the "Natural Disaster Hazard Score."

Each of the five components were measured on a scale of one to 100 — with 100 being the most hazardous metro area for the category and one is the least hazardous. The overall Natural Disaster Hazard Score is an average of the five components' frequencies.

No. 12 Kansas City, Mo.

Most at-risk hazard: Floods (75)

Median home price: $200,000

No. 11 Oklahoma City, Okla.

Most at-risk hazard: Fires (67)

Median home price: $174,000

No. 10 Dallas, Texas

Most at-risk hazard: Fires (63)

Median home price: $285,000

No. 9 Portland, Ore.

Most at-risk hazard: Earthquakes (81)

Median home price: $390,000

No. 8 New Orleans, La.

Most at-risk hazard: Hurricanes (100)

Median home price: $210,000

No. 7 Minneapolis, Minn.

Most at-risk hazard: Floods (91)

Median home price: $265,000

No. 6 Houston, Texas

Most at-risk hazard: Floods (68)

Median home price: $232,000

No. 5 Austin, Texas

Most at-risk hazard: Fires (73)

Median home price: $296,000

No. 4 New York, N.Y.

Most at-risk hazard: Floods (75)

Median home price: $380,000

No. 3 Riverside, Calif.

Most at-risk hazard: Fires (96)

Median home price: $366,000

No. 2 Los Angeles, Calif.

Most at-risk hazard: Earthquakes/fires (100 each)

Median home price: $600,000

No. 1 Washington, D.C.

Most at-risk hazard: Hurricanes (82)

Median home price: $380,000