National Mortgage News presents its third annual

The program is a collaboration between National Mortgage News and the

Following a thorough assessment of the organizations, the survey data was analyzed and the companies received an overall score that determines their rankings. The overall score comprises the employee survey (worth 75%) and the employer questionnaire (worth 25%). To qualify for consideration, organizations with 25 or more employees need a minimum response rate of 40% while organizations with 25 or fewer employees need 80%.

Companies must opt-in to the rankings and participation is open to a standalone mortgage lender, mortgage broker, mortgage servicer, or mortgage unit of a diversified financial services firm with at least 15 permanent employees working in the United States. Not all companies that participate in the survey make the list. The survey also includes open-ended and demographic questions.

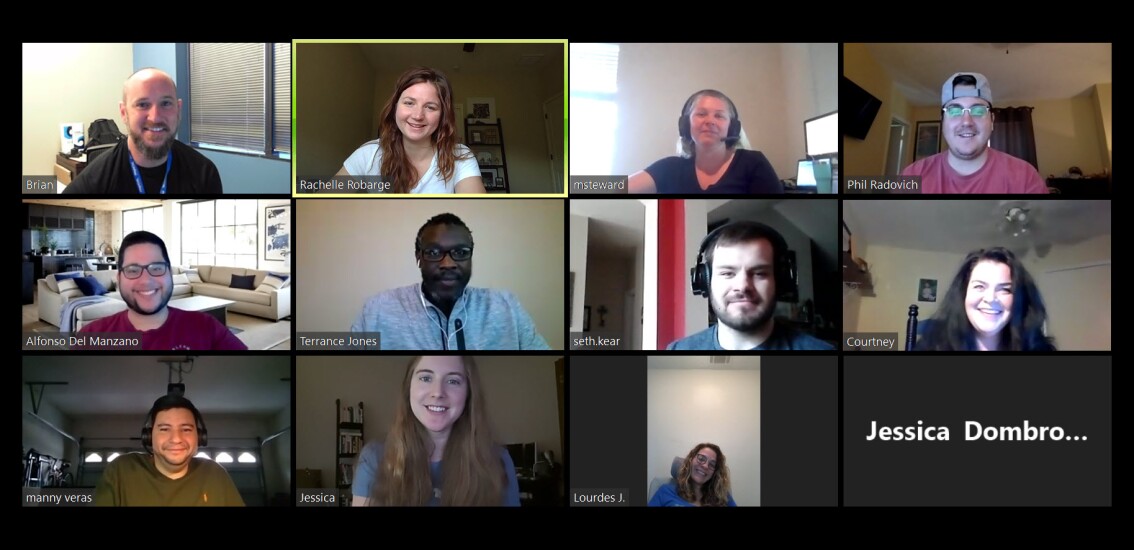

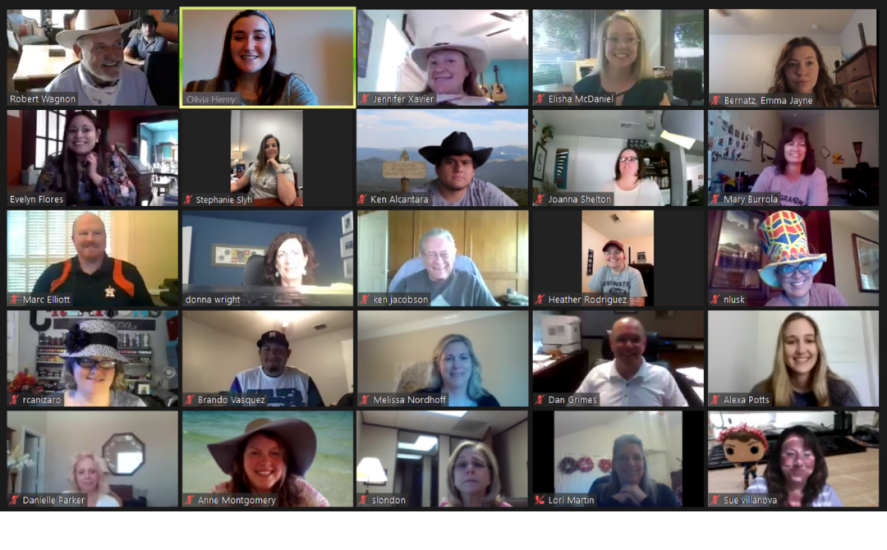

In addition to anecdotes about corporate culture, special events, HR policies and benefits, executives and employees gave us a peek at how the 50 lenders, brokers and servicers on the list make things fun — both at the office and in this year’s

See how companies in the small, mid-sized and large categories measured up against each other:

>

>

>

>

>