The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

The original company was founded by John Robbins and

The principals at this new version of American Mortgage Network include Joseph Restivo, president and CEO; David Wallace, executive vice president and chief financial officer; and Sherry Chappell, chief operating officer.

Restivo was the founder, owner and operator of two mortgage brokerage firms and one mortgage bank. Wallace previously was EVP, CFO and co-founder of Bexil American and the division CFO of American Mortgage Network-Wachovia Bank. He also has held several other executive-level jobs within the mortgage industry. Chappell has served as the COO for several national mortgage companies.

Rather than setting up a traditional ownership structure, all of the equity in the company is distributed through an employee stock ownership plan. The founders supplied the initial equity for the company but pledged their ownership share to the ESOP. AmNet plans to sell its servicing rights rather than retain them and use those proceeds to purchase assets for the plan as well.

"I saw an opportunity to create something very exciting for retirement for all the employees and get everybody to work together as a team, versus having operations and sales constantly butting heads. It really was a way to band everybody together," Restivo said in an interview at the recent Mortgage Bankers Association annual convention.

"In our minds, the traditional way of building a mortgage bank with either our own funds or with big private equity coming in wouldn't allow us to do this. So we're giving up all of our equity, it's going into an ESOP and we're going to earn our shares back with the rest of the employees," Wallace said during the interview.

AmNet chose the ESOP structure in part because it would allow the company to make corporate decisions in conjunction with its employees, rather than a venture capitalist investor who might have little knowledge of the mortgage business, Restivo said.

There have been several other instances of ESOPs in the mortgage industry. For example,

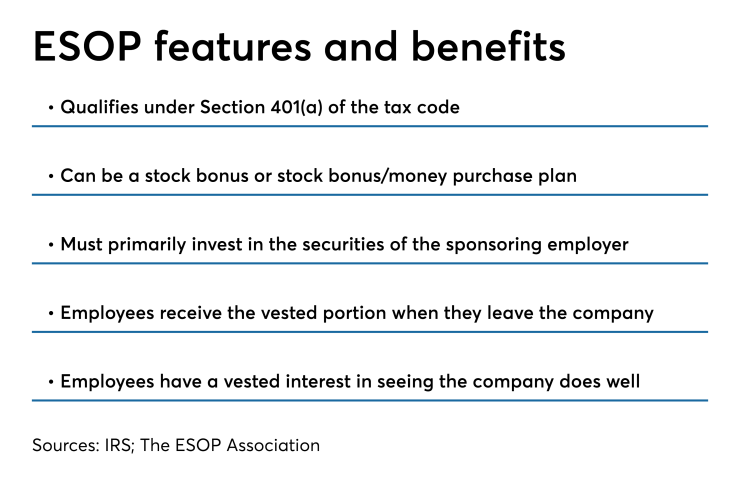

The ESOP is set up as a risk qualified retirement plan under section 401(a) of the tax code. The profits of the company will be invested in real estate assets and generate income for that plan for eventual distribution for employees that reach retirement age.

Under this structure, the top executives will earn roughly the same as the top originators and top operations staff, Wallace said.

Furthermore, all of the company's staff and executives are $15 or $16 per-hour employees, although there is the opportunity to earn additional compensation on a variable basis, based on the success of the company.

"We designed this thing to last and not cripple the company when volume goes down," Restivo said. "We wanted to put ourselves in a position where we'd never have to lay people off because of a change in the market.”

Another differentiator will be the technology setup.

"The philosophy with what we're doing now, with technology being so much more advanced than when I ran the last company, is we wanted to make a 100% web-based platform, so anybody can be anywhere in the world and be able to work," said Restivo. "We have decentralization, we have more efficiency, we do not have to hire a huge IT department to manage technology. We push that support back on the vendors."

A browser-based, cloud-based system enables the company to ensure data security and managing customers' personal information, he added.

The new AmNet is 100% retail, focusing on conventional loans as well as Federal Housing Administration and Veterans Affairs offerings. It also will fund non-qualified mortgages, particularly jumbo loans.

As of late October, the company was licensed in nine states, with 14 more pending.