Consumers blame speculative home flippers and wealthy out-of-towners for soaring home prices, but the blame may be misplaced, given many economists' views about the broader factors at play.

About 70% of consumers blame house flippers and speculative investors for pushing up home prices, while 66% say wealthy residents moving in from costly markets have increased housing costs to unsustainable levels, according to ValueInsured's 4Q Modern Homebuyer Survey.

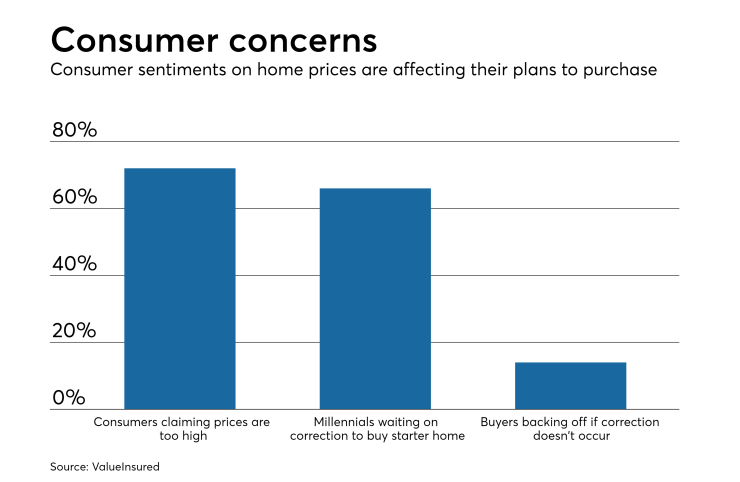

As a result, 59% of prospective homebuyers, including first-time and upgrade buyers, are planning to wait for a "meaningful" housing market correction before proceeding to buy a house, and 14% say they will call it quits altogether should a correction not occur, according to ValueInsured, a Dallas-based down payment insurance company.

The results are curious, given that economists attribute rising prices to a

"The ValueInsured Survey revealed some concerning evidence about the changing psychology of the housing market," housing economist Robert Shiller said in a press release. "We will be watching these numbers as they unfold over the future."

The idea that people are more skittish about housing is also echoed in Fannie Mae's most recent

In the ValueInsured survey, about 66% of millennial buyers looking to purchase a starter home say they will wait for a market correction to buy a house, and 36% of move-up homebuyers planning to sell will also wait to purchase their upgrade until after a correction.

The survey also found about 75% of Americans claim their local housing market is "cooling." Millennials in particular believe now is a good time to sell, but only 38% of those wanting to purchase a starter home believe it's a good time to buy, which is down eight percentage points from the same period a year ago.

This is significant because the depletion of starter home inventory from the market put upward pressure on house values as homebuyers fought over little supply, pricing some out of the market entirely. The addition of this inventory will help support consumer

Still, 78% of urban residents and 72% of consumers overall report that home prices are still too high; these sentiments are up 13 and 10 percentage points, respectively.

And as more Americans believe property values are too pricey, housing market characteristics evolve from having an influx of bidding wars to more consumers waiting on prices to cool before making a purchase.

For example, "Southern California is in its worst housing slump in over a decade, Seattle leads the nation in fastest home-price drop, and North Texas has the largest sales decline in seven years. Buyers have switched from hoop jumpers to bargain-hunter mode. Expect the market to stall in the near term," ValueInsured CEO Joe Melendez said in the release.