Commercial and multifamily mortgage debt outstanding grew 1.3% in in the first quarter of 2019, aided by low mortgage rates and the steady incline of property values, according to the Mortgage Bankers Association.

The combined debt outstanding increased $45.4 billion in 2019's opening quarter, up from last year's growth of $44.3 billion, but down from the $68.5 billion jump in

"The commercial and multifamily mortgage market has been very strong in recent years — with low interest rates, solid fundamentals and increasing property values," Jamie Woodwell, the MBA's vice president of commercial real estate research, said in a statement to NMN. "All of that has been pushing mortgage debt outstanding higher, and largely remains in place today."

The collective debt total rose to $3.46 trillion. The multifamily segment climbed to $1.4 trillion, with an increase of $17.9 billion during the first quarter.

"Mortgage debt

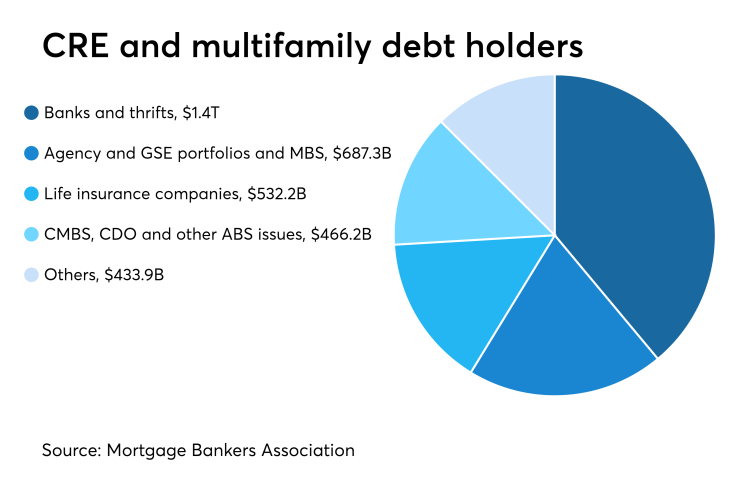

Commercial banks and thrifts hold $1.4 trillion of commercial and multifamily

"REITs, finance companies and nonfinancial corporate businesses also showed strong appetites last quarter, with each growing their holdings by more than $1 billion. The depth and breadth of growth among investors signals the interest in the sector," said Woodwell.