Housing finance agencies reported increased demand for their loan products, but at the same time the inventory shortage constrains activity and drives them to work with other public entities to find solutions,

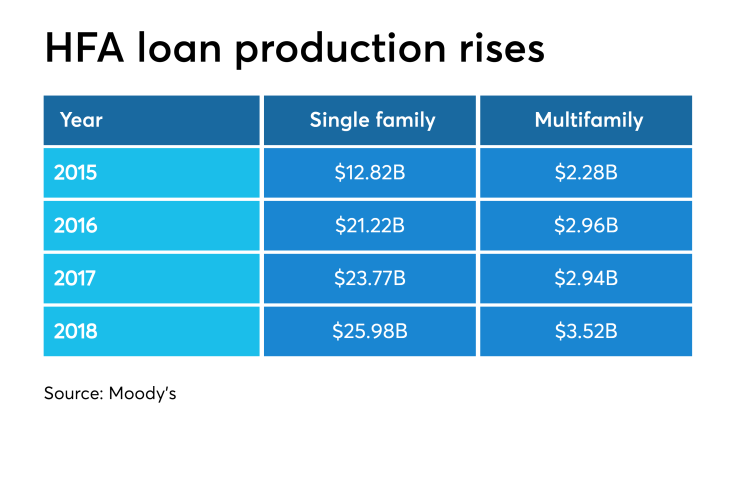

Over the past four years, the HFAs have doubled their production of single-family low-interest rate loans, a credit-positive for these government entities, the Moody's report declared.

Nearly $26 billion in HFA originations came in 2018, up from $12.8 billion in 2015.

Beyond their traditional product lines, several HFAs moved towards meeting specific needs. For example, programs in Ohio and Maryland target potential homebuyers with student loan debt. In Connecticut, the Teachers Mortgage Assistance Program exists.

To create more rental affordable rental housing, HFA multifamily bond issuance grew to $3.5 billion in 2018 from $2.3 billion in 2015.

"Increased loan production leads to increases in short-term and long-term revenue for HFAs and allows them to continue to meet their mission of providing affordable housing in their respective states," said the report, written by Rachel McDonald, a vice president and senior credit officer at Moody's. "Selling loans in

"HFAs that

Selling loans in the secondary market allows some HFAs to work with non-first-time buyers and buyers that seek affordable housing, but earn more than area's median income, Moody's added.

But the supply crunch affected the HFA's mission. The number of newly built homes that sell for less than $150,000 declined since 2006, due to the high cost of land, materials and labor.

Nearly 150,000 new homes sold for under $150,000 in 2006; through the first three quarters of last year, there were less than 20,000.

Another factor affecting affordability is wages have not risen as quickly as housing and/or rental prices, Moody's said.

To combat the supply crunch, HFAs are working with other municipal, state and federal agencies "to stretch their capacity to produce single-family and rental housing loans," the report said.

"In New York City, for example, the city's affordable housing plan, Housing New York, involves the collaboration of a range of city agencies, the city's HFA, the state HFA, and other state and federal entities. The largest proportion of the $41 billion outlined in the plan comes from bonds issued by New York City Housing Development Corp. and private financing, followed by the city's own capital and low-income housing tax credit equity. LIHTC gives investors a dollar-for-dollar reduction in their federal tax liability in exchange for equity investments in affordable rental housing," Moody's explained.

Another way HFAs use state and federal money is to