Much has been made of online competition's threat to traditional brick-and-mortar retail, and that's made lenders wary, but retail is by no means all doom and gloom, particularly this holiday season.

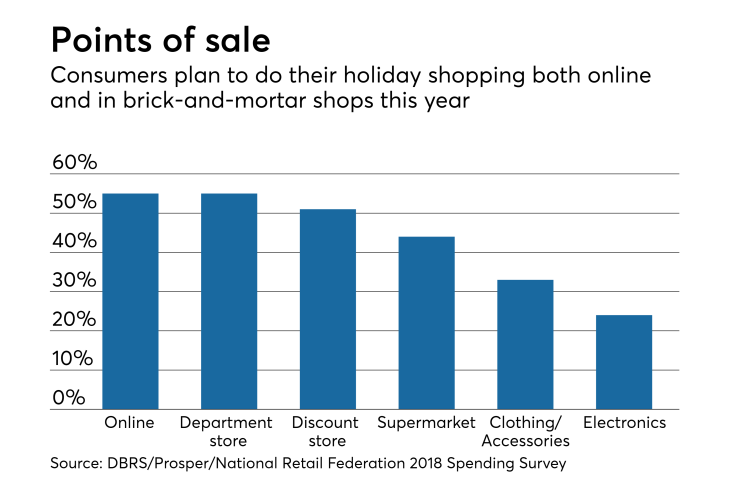

Holiday sales in the retail sector are on track to top $1 trillion for the first time ever, DBRS noted in a recent report, citing an eMarketer forecast. And while more than half of shoppers do plan to shop online, an equal percentage also plan on buying in department stores, data from Prosper and a National Retail Federation spending survey show.

"I think retail is changing and evolving, but I think the space will get repositioned, and some people in retail will come out OK," said Patrick Ward, founder and president of MetroGroup Realty Finance in Newport Beach, Calif.

There is still risk in retail, as examples like the Toys R Us liquidation this year showed. But the plight of stores like Toys R Us isn't necessarily representative of the whole sector. Supply and demand for some other retailers are better matched.

"Unbridled, aggressive growth (for retailers) is sometimes bad, but growth for individual retailers these days can be deemed 'healthy' (in some cases) because it's tempered and supported by demand," said Kevin Fagan, a vice president and senior analyst at Moody's Investors Service.

For example, off-price retailers like the TJX Cos., the corporate parent of TJ Maxx and Marshalls, "are more resistant to e-commerce competition," Moody's finds in a report by analysts Thuy Nguyen, Philip Kibel, Jason Tam and Nick Levidy.

More than half of consumers plan to shop at a discount store for the holidays, according to the Prosper and National Retail Federation data DBRS analyzed.

Growth estimates for supermarkets, which could see their current estimated share of e-commerce grow due to online giant

Mortgage lenders are wary of financing department stores, but 55% of consumers do plan to shop in them this holiday season.

Whether a particular department store is a good prospect for financing may depend on how it is situated.

"If you have old school malls or power centers that don't have other amenities, people are really holding back on loan proceeds," said Mitch Paskover, president of Continental Partners, a company that provides advisory services for real estate capitalizations.

But neighborhood shopping centers continue to fare well as they draw consumers picking up necessary items more regularly, said Ward, whose company has a focus on the Southern California market, but also has been involved in some financings in other parts of the country.

"There's a lot of renovation," he said, noting that some stores offset the encroachment of e-commerce by downsizing their space. Some even get to the point of being "e-tailers" who use their physical storefront as a furniture or clothing showroom and conduct the sales online.