While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

The Home Value Index — based on data from home purchases and mortgage refinances — grew 5.01% from November 2017, while year-over-year gains have slowed severely in 2018. On a month-over-month basis,

"Home values continue to increase, but the rate of increases has started to slow. For much of 2018, interest rates have been rising, causing the combined price and associated payment to give some buyers pause," Bill Banfield, executive vice president of capital markets at Quicken Loans, said in a press release. "The economy appears to remain strong with a low unemployment rate suggesting home prices could continue to increase even if at a slower rate."

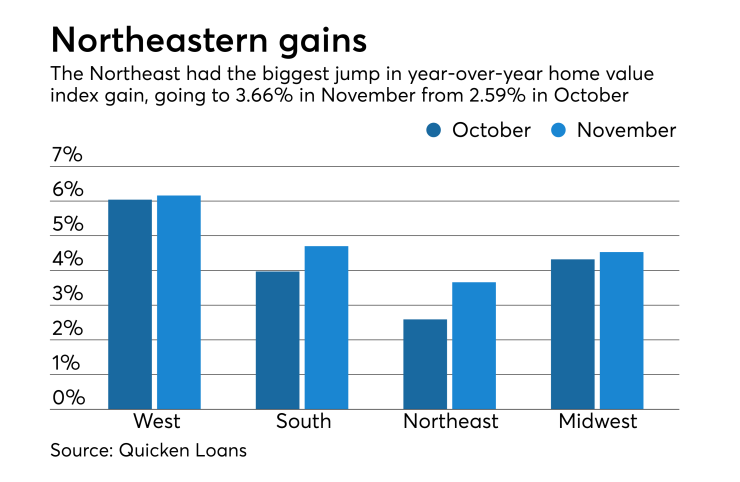

On a regional basis, the West led year-over-year home value increases with 6.16%, followed by 4.7% in the South, 4.53% in the Midwest and 3.66% in the Northeast. However, the Northeast had the biggest year-over-year jump in November compared to October's 2.59%.

With home price appreciation slowing, the market comes closer to equilibrium between buyers and sellers. Appraisal values were on average 0.36% lower than homeowners' estimates in November, according to Quicken's latest Home Price Perception Index, marking the ninth-consecutive month with a difference of less than half a percent. The discrepancy, albeit a small one, is partly due to

"Homeowner perception staying at a steady level is a sign of a sturdy housing market," said Banfield. "Some homeowners may not be as aware of home value changes as the professionals who study the real estate market every day, so any large, sudden spikes or drops in home values, are often reflected by a swift widening gap in the HPPI."