Borrowers recovering from foreclosure might not be in as much hot water as they perceive, according to a LendingTree report.

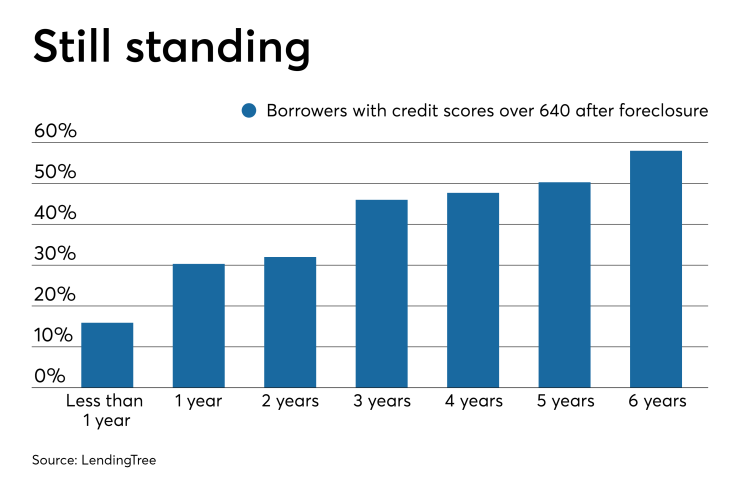

Credit scores can decline around 150 points or more following a foreclosure, but many consumers still maintain healthy figures even after this. Within a year of foreclosure, over 30% of consumers have a credit score of 640 or higher, while 7% and 2% end the year with a score above 680 and 740, respectively.

On average, credit scores rise about 10 points per year after a foreclosure — which falls off a consumer profile after seven years.

In as few as two years post-foreclosure, borrowers are reentering the housing market, though they have to pay a premium to do so, according to LendingTree. Consumers with a credit score above 740 two years after a foreclosure paid an average annual percentage rate of 5.02%, compared to 4.7% for those with the same score but without having had a foreclosure (or without one in seven years).

Though 600,000 homes went into foreclosure across the country last year, it's the lowest this figure has been since the housing bubble popped. Comparatively, foreclosure volume hit an all-time high of 2.9 million in 2010.

"The