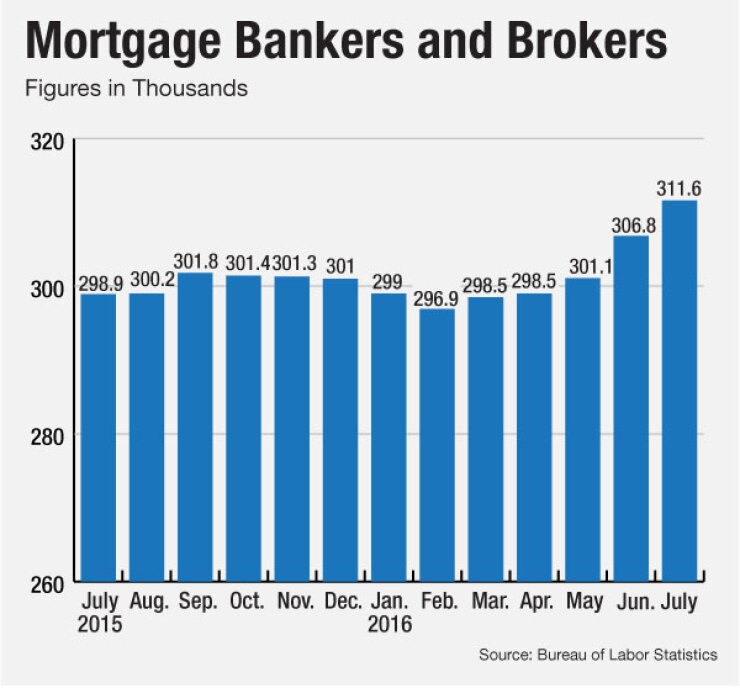

Independent mortgage banking and brokerage firms continued to expand their workforce in July as they added 4,800 new employees to their payrolls.

The Bureau of Labor Statistics reported Friday that employment in the nonbank mortgage and brokerage sector rose to 311,600 in July,

This follows a strong month in June when nonbank mortgage lenders increased their payrolls by 5,700 full-time employees. The June number was revised down by 200 jobs in Friday's BLS report.

The recent surge in hiring has been fueled by low mortgage rates and robust new and existing home sales. For many years, lenders have depended mainly on refinancing activity. But mortgage originations this summer have been bolstered by a surge in home sales.

Sales of

The National Association of Realtors expects 2016 will be the best year for existing homes sales since the housing bust.

Fannie Mae acquired 274,000 home purchase loans in the second quarter, up from 210,000 in the prior quarter.

Meanwhile, independent mortgage banks pocketed $1,686 on each loan they originated in the second quarter of 2016, up from $825 per loan in the first quarter, according to a Mortgage Bankers Association report. So the independents have the resources to hire new loan officers and back-office staff.

Overall, BLS reported that the U.S. economy created 151,000 new jobs in August compared to 275,000 in July. The July jobs number was revised up from 255,000. The U.S. unemployment rate held steady at 4.9%. There is a one-month lag in BLS reporting of mortgage industry jobs data.

"Over the past three months job gains have averaged 232,000 per month," BLS said.

Fannie Mae chief economist Doug Duncan said the jobs report was weaker than expected and it is unlikely Federal Reserve officials will vote to raise interest rates at their September 21 meeting.

"Despite recent attempts by Fed officials to convince the market that economic conditions are ripe for a rate hike, we believe today's August jobs report did not pass the high bar needed for a target rate increase this month," Duncan said in a note Friday morning.

Bank of the West chief economist Scott Anderson also expects the Fed will delay a rate hike.

"The Fed had been jawboning for a rate increase, perhaps as early as this month, but today's jobs data doesn't likely meet most members threshold for an imminent rate hike," Anderson said in a note Friday.