Mounting compliance costs, squeezed margins and the end of the refinancing gravy train are expected to prompt more mergers and acquisitions among mortgage lenders—provided buyers and sellers meet halfway on price.

That's always the hard part.

Previously, sellers wanted prices based on past production volumes, while buyers wanted to set prices based more on what future volumes were likely to be. Now, both sides may feel they have a better handle on operating costs and market pricing than they did when

Still, "There's always going to be tension" between buyers and sellers, Reinhart says.

"We're not seeing a ton of deals go through," he says.

"I think we're going to see more deals or hear of more as the year progresses, and it will continue next year," says Mark Stafford, managing director and founder of New York-based private investment banking and corporate finance advisory firm MS Capital Advisors.

If a lender is going to sell, this may be the best time to do it, says Brian Koss, an executive vice president at Danvers, Mass.-based lender Mortgage Network.

"This is the height of value you are going to get," he says.

His company, a retail home loan lender that originates about $2.5 billion annually, primarily on the East Coast, has no plans to sell or buy, he says. His experience with a range of public and privately held lenders over time leads him to believe the best course is to stay with a private-held lender with sufficient capital resources, but without investor-driven pressure to expand in a slower market cycle.

When acquisitions do occur, they may be in the form of strategic geographic asset purchases or branch rollups rather than purchases or mergers of companies, says Koss. Lenders' value resides primarily in the form of loan officers who can help bolster volumes and effective managers who have assembled and retained teams of such players, he says. Some owners who quit the business prefer to sell employees and management teams for this reason.

"If you don't lock up people" as part of the merger or acquisition, the deal can easily lose value quickly because that talent can defect soon after to another shop, Koss says.

Having originators who can efficiently produce sufficient loan volume is a key part of what is driving acquisitions today, says Stan Middleman, chief executive of Mount Laurel, N.J.-based Freedom Mortgage Corp. Lenders that originate below a certain volume may have trouble remaining profitable given how thin loan margins have been because they lack economies of scale, he says, but this in part depends how strong a company's operations are and how much its volumes have fluctuated.

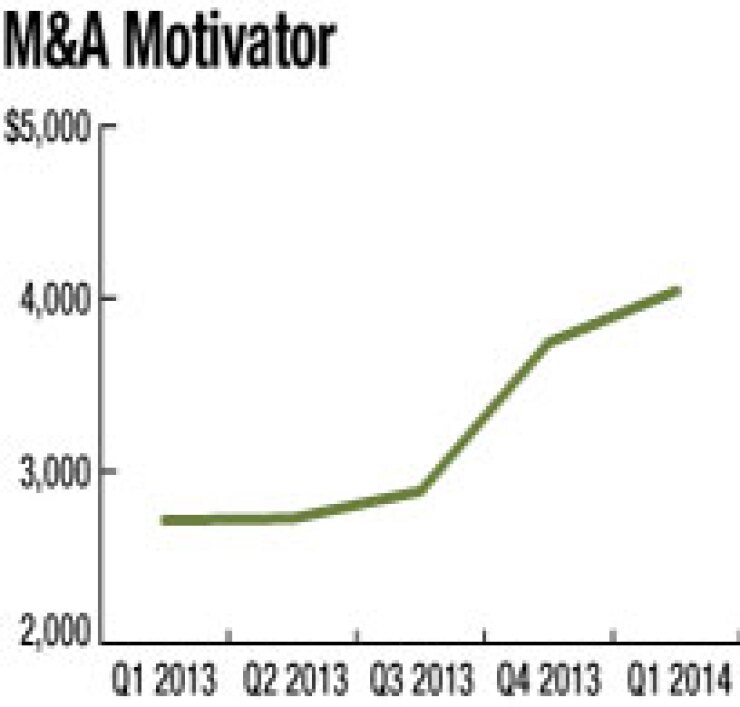

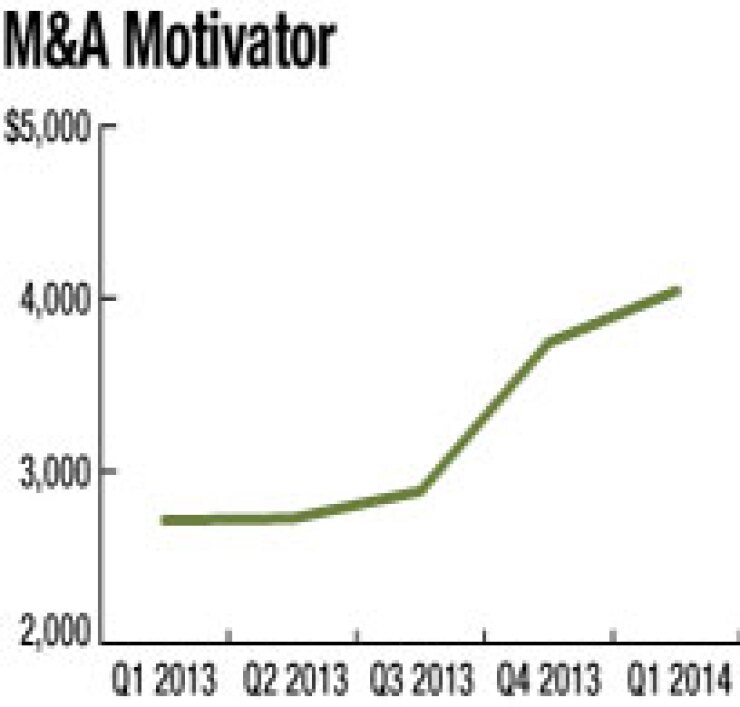

The required compliance and information technology required to handle loans given rising costs could challenge players that produce much less than $500 million a month, he says. Per-loan origination costs have been steadily rising, according to MortgageStats.com surveys. As of the first quarter of this year, they had increased on average to $4,044 from $2,714 a year earlier.

But the business' rising costs are not necessarily squeezing only smaller players, Middleman says.

"If you're small enough you can manage your expenses by getting smaller. It's the people in the middle, whatever you would define the middle to be, that are the most challenged, and they have to decide whether they are going to get smaller or bigger" to bring their operations in line with current volumes, origination costs and margins, he says.

Middleman feels that prices are currently fair. "At the end of last year was the peak of the seller's leverage. That's when they were profitable and they could tell somebody 'no' and mean it. They rebounded a little, but I don't think they're as optimistic coming into the third quarter," he says.

This year Freedom bought the assets of San Diego-based BluFi Lending, a mortgage lender with five branches in California and Nevada. Terms of the deal were not disclosed, but Middleman says he was pleased enough with the results to continue selectively buying in areas or channels that allow his company to expand without overlap with its current operations.

Some are even more optimistic about buying prospects.

"I absolutely think it's a buyer's market," says Stafford. "The sellers don't have many alternatives."

But some buyers are under pressure as well, Koss says.

Certain buyers that remain short on originations because they had a refinance-focused business prior to the change in interest rate environment last year are under more pressure to buy than their acquisition targets are to sell, says Koss. These buyers want to find sellers who are better positioned for the current market environment than they are, and the number of those types of players that are available for sale is dwindling. As a result, some buyers "are a little more aggressive," Koss says. As a result, he feels some deals will get done at higher prices than they normally would be.

Because some companies are under pressure to buy, "It's pretty much a sellers' market," according to Chuck Klein, a managing partner at Austin, Texas-based advisory firm Mortgage Banking Solutions who specializes in M&A.

But multiples for the last six months have been down from last year, closer to two times recent earnings than three, with buyers pushing for more of it to be paid as an earn-out after the deal closes, says Klein.

Stafford is skeptical lenders desperate for volume still have enough resources to buy, and that sellers with strong purchase volume resources would be willing to agree to deals with companies that have questionable financial futures. He says he is not surprised there are different takes on whether it is currently a buyer's, a seller's or fair market.

"There is always a disconnect in this market" regarding buyers' and sellers' perception of companies' value, says Stafford.

More rational, numbers-based potential buyers such as private equity firms and banks backed away from the sector when loan volumes and profits began flagging last year, Stafford says. Also, pending stricter Basel III capital restrictions on mortgage servicing rights can be a deterrent for banks. However, some prospective buyers from the independent mortgage sector with the capital strength to stay the course in the business may find the opportunities for consolidation attractive.

"I view this as a very ripe time for the strong to get to get stronger," he says.

Others say there is some limited bank buying interest.

"We're seeing banks coming back in," says Klein. However, these are primarily regional and community banks with $500 million to $2 billion in assets. The appeal generally lies in cross selling and the ability to bolster their deposit bases, he says.