If reform of the government-sponsored enterprises leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, Zillow estimated. But lenders aren't convinced this housing finance staple is in danger of being replaced.

Taking away the 30-year mortgage at this time could bring back a sluggish housing market and even further reduce the for-sale inventory, Aaron Terrazas, senior economist at Zillow, said in a press release. "If monthly payments do rise and, more importantly, stay elevated, at some point we'd expect home prices to come down a bit in response to this decreased purchasing power, and some long-time owners could opt not to sell to preserve their smaller monthly payments."

That is a possibility the mortgage industry is discounting.

"The 30-year [conforming] fixed-rate mortgage isn't going away anytime in the foreseeable future," said Mat Ishbia, president and CEO of United Wholesale Mortgage. "That's not realistic. There is less than a 1% chance" of that happening.

"Could the world we live in change? Yes, the world we live in changes every day. However, will this extreme of a change happen? No, it won't, it wouldn't be good for consumers, it's not good for the housing industry," he said.

The 30-year mortgage was created following the Great Depression in order to provide liquidity to

But there are proponents of eliminating the 30-year fixed-rate mortgage like

Meanwhile, there is a disagreement in Congress on whether there should be an explicit government guarantee. A bill being crafted in the Senate echoed

Opponents of the government guarantee said it reduces the risk to the taxpayers if there is another large wave of defaults as there was during the Great Recession. The counter-argument is without the government guarantee (the market before the crisis had an implicit guarantee), investors would not purchase agency mortgage-backed securities.

Those that want to get rid of the 30-year fixed-rate loan state it is not commonly used to finance residential properties in other nations, which shows the market can function without it.

"But it is a staple of what we do in our society and that's not changing," said Ishbia. Rather, there is more of a chance, however unlikely that might be, of products like the 40-year fixed-rate mortgage (once a staple of home mortgage lending in California) coming back than the market moving to shorter term products.

"A shorter loan period would mean the lifetime cost of the home is lower, and some households may be able to absorb the extra monthly cost on their mortgage," Terrazas said. But in the nearer term, first-time homebuyers or buyers on the margin could feel a real pinch as homeownership becomes significantly less affordable."

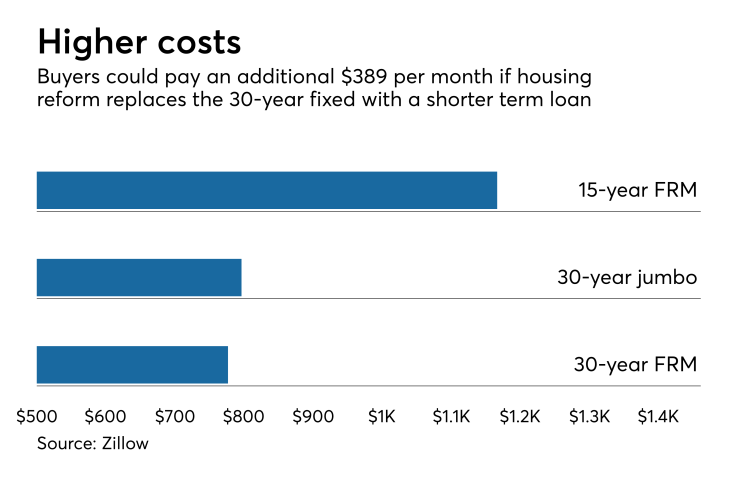

In its example, Zillow used December 2017's nationwide median home value of $206,300. To purchase a home at that price, a 30-year conforming FRM would have a monthly payment of $777. The 15-year conforming FRM would have a payment of $1,166. While shorter-term mortgages generally have lower interest rates, it costs more per month because there are fewer payments.

For that point, Zillow made a comparison between the 30-year conforming and the 30-year nonconforming jumbo. In this case there was only a $20 per month difference in payment. The rate on jumbo mortgages

Still, "with all of the regulations and with changing in the housing industry, it makes it more important than ever to shop," Ishbia said.

Encouraging consumers to compare products and rates was likely the main point of Zillow's release, especially in a future where other product types besides the conforming loan are more competitive in the marketplace. "Mortgage rates aren't the same in every situation for every person. People should shop for a mortgage and compare multiple lenders by using a mortgage broker," Ishbia said.