Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

The second half of 2018 was "a turning point" for the housing market as the multiyear period of low interest rates combined with strong home price appreciation came to end.

"We expect the relative effect of rising interest rates on housing affordability in the U.S. to become less pronounced in 2019, as home price growth moderates, wage growth continues, and shifts in demographics drive growth in millennial home purchases," S&P said in a press release.

Mortgage rates should average 5.2% for 2019, up from 4.5% currently and 4% at this time one year earlier, the report said. There should be a 5% average for the first quarter, rising to 5.4% by the end of the year.

"While still a relatively low interest rate, this causes a measurable impact on home prices," S&P said in its report. "With rising rates, would-be buyers have been less incentivized to enter the purchase market. This, in turn, has put downward pressure on prices, which slows growth."

The report cites the Mortgage Bankers Association's 2019 projections of $1.63 trillion in volume this year, down from $1.64 trillion in 2018.

There should be "tempered" home price appreciation during the year, with demand strengthening as millennials continue to enter the purchase market.

Fannie Mae recently updated its forecast to project average rates for the 30-year mortgage to

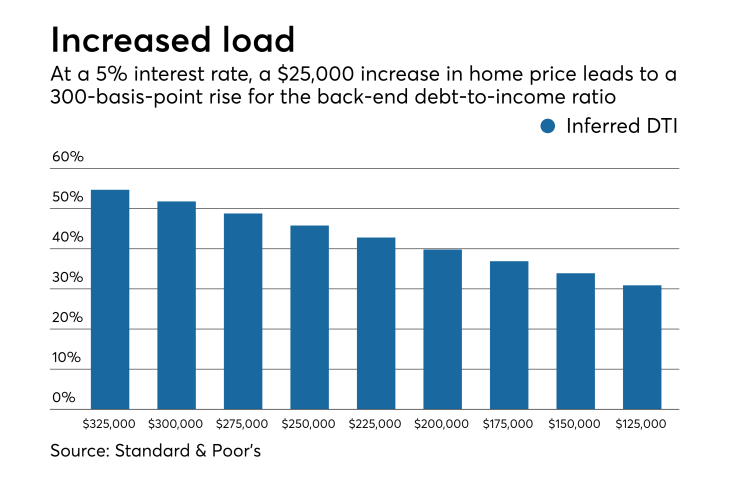

However, a consequence of the continued shift to a purchase market is an increase in debt-to-income ratios, "depending on how wage growth tracks interest rate increases given the 'income' portion of the calculation," S&P said. In computing home prices along with income and debt, it found that to remain within a 43% back-end DTI ratio (the qualified mortgage threshold), borrower purchasing power — a direct measure of affordability — would decrease $25,000 for every 125-basis-point increase in mortgage rates.

For existing mortgages, the largest driver of defaults is job loss. There should be a slight drop in the unemployment rate during 2019, "which could bode well for residential mortgage performance and offset some of the affordability concerns that have been highlighted in the media," S&P said.

The increase in the

"Barring any dramatic legislative/policy-driven changes in 2019, we could still see some minor movements in mortgage financing to the private markets," the report said. "Much of this depends on investor appetite for nonagency paper and

The non-qualified mortgage securitization market should double its issuances to $20 billion, this year, after doubling between 2017 and 2018.