Even after the

Under Consumer Financial Protection Bureau rules, when an investor makes loss mitigation available, servicers must have a standardized process to evaluate borrower applications for help.

"The mandated evaluation process, including notices regarding denial and appeals rights, includes features similar to some of those in Making Home Affordable," said CFPB spokesman Sam Gilford.

But once HAMP ends, there will no longer be one clear, programmatic standard for mortgage modifications.

Industry discussions about "life after HAMP," including a Treasury roundtable by the same name last September, have explored the concept of developing a new standard for modifications. Stakeholders including the CFPB, Federal Housing Finance Agency, the Treasury and consumer and industry groups have been working on filling the void, but won't have a consensus solution in place by January.

The debate will continue over whether there should be more discretion or standardization in loss mitigation processes, but in the absence of a unified standard, industry participants will employ myriad proprietary loss mitigation options.

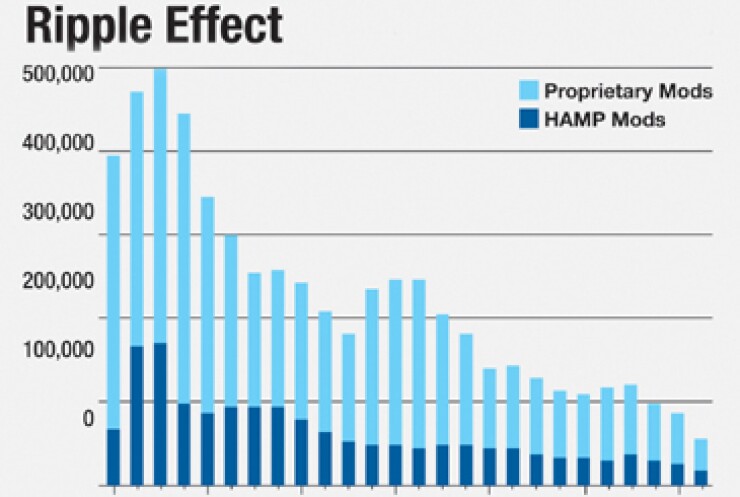

It won't be a tough transition. Proprietary modifications have always outnumbered HAMP workouts, according to data from Hope Now, a consortium of mortgage companies, investors, counselors and regulators. Between September 2009 and February of this year, more than 2.5 proprietary modifications have been completed for every HAMP workout.

But while it won't be a concern from a volume standpoint, it will create confusion for consumers and investors.

"Do we go back to this Tower of Babel where everyone has their own type of modification? It's going to be very confusing," said Mark McArdle, deputy assistant secretary of the Treasury Department's Office of Financial Stability, which has been responsible for overseeing Making Home Affordable in the private-label securities and portfolio lending markets.

Without HAMP, the industry will look to loss mitigation programs designed by the government-sponsored enterprises as a short-term standard. Indeed, Fannie Mae and Freddie Mac's standard and streamlined modification programs will continue to be options for GSE borrowers heading into 2017, FHFA director Mel Watt confirmed in a

Those GSE modification programs share many attributes to the MHA options, which have only been available to crisis-era borrowers whose loans were originated on or before Jan. 1, 2009. But the amount of "compensation" that Freddie Mac modifications pay to borrowers and servicers, for example, is lower. Ultimately, the existence of GSE modifications without HAMP reduces borrowers' options and potentially the extent to which they could lower their payments.

The GSEs offer borrowers who remain current on their HAMP-modified loan $1,000 principal reductions each year for up to five years, provided the mortgage has not been repurchased. After five years of on-time payments, borrowers receive an additional $5,000 principal reduction.

Depending on how many days' delinquent a loan is, servicers receive between $900 and $2,100 within two months of a successful GSE HAMP modification, compared to $400 to $1,600 for standard and streamlined modifications.

The GSEs' standard and streamline modification programs don't offer borrowers pay-for-performance incentives the way HAMP does. The exception is a

"I think the incentives going away is where the impact is going to be seen," said Eric Chader, a senior vice president at consulting firm Collingwood Group who worked on Making Home Affordable initiatives at the Treasury between 2010 and 2013.

While they lack the same incentives offered under MHA, the GSEs' other modification programs do fit the bill as successors to HAMP, particularly as the FHFA continues to better align Fannie and Freddie's respective programs. Meanwhile, Quicken Loans is advocating the industry take the concept a step further with what it's calling "One Mod."

The idea is that "One Mod" would serve as a standard for loan modifications across government agencies that could be used as a benchmark for the private market.

It would have very simple documentation and a standard payment reduction aimed at shaving 20% off the current mortgage payment, with the aim of keeping as many borrowers as possible in their homes. It could also help servicers to minimize foreclosures and other loss mitigation expenses.

"That is the structure we're trying to build," said Mike Malloy, vice president of servicing at Detroit-based Quicken. "We would start tomorrow if anyone would let us."

Defining a Legacy

There will be plenty of loose ends to tie up after Making Home Affordable comes to an end. Modified loans will remain in runoff and continue to face step-ups or "resets" to their interest rate over time, putting new stresses on borrowers.

Treasury HAMP modifications on average reduce payments 45% initially, but the payment reduction is closer to 20% to 25% after step-ups. The Urban Institute Housing Finance Policy Center is expecting that modifications going through step-ups will increase the HAMP default rate by another 5% to 6%. However, the volume of rates resetting higher should trail off after 2017.

The standardized net present value model that was used across the industry by HAMP servicers also will end with the program.

"While individual servicers and the GSEs have developed their own NPV models and will continue to use them, there will probably be less standardization and transparency around NPV since we are no longer around to govern the model and enforce its use," said McArdle.

In addition, HAMP data reporting and the consumer help hotline will likely end if they're not acquired and continued by public or private entities. But it's possible that a consumer advocacy group would want to continue the hotline, and the secondary market will have some interest in building on the existing modification data.

While HAMP allowed the market to amass a certain amount of performance information on payment-reduction modifications, investors still consider the scope of that information limited and that has made it tough to price the product, said Tom Millon, president and CEO of the Capital Markets Cooperative.

Another outstanding question is the future of the post-modification financial counseling that borrowers receive after completing the HAMP process after Making Home Affordable ends.

"Counseling's precise role is still being determined," said Freddie Mac spokesman Brad German.

Most likely, counselors will fill the void with a shift to prepurchase counseling, according to NeighborWorks America spokesman Doug Robinson.

"Once [people are] helped by a foreclosure prevention counselor, they are more likely to think positively about working with a housing counselor prior to their next purchase," he said.

Nonprofits that employ many counselors will also continue to have a role in other loss mitigation areas, such as nonperforming loans sales, which the FHFA plans to support even after MHA ends.

Ultimately, whether the changes Making Home Affordable brought to the market persist depends on whether the next group of power brokers in Washington looks back on it as a success.

"That's a philosophical and political question," said Les Parker, an industry veteran and contributing writer to The Mortgage Professional's Handbook, a guidebook on the inner-workings and history of the mortgage industry published earlier this year.

But there are many arguments and regulatory requirements that suggest loss mitigation methods will continue to follow in the program's footsteps even after it ends.

Making Home Affordable "should be, I think, the baseline for loss mitigation practices going forward," Chader said.

Whether the loan performance and consumer benefits are strong enough to financially support MHA-style loss mitigation in the future remains to be seen, particularly given servicer concerns about its high costs. The answer may not be clear until another large-scale downturn surfaces as it inevitably does in the cyclical mortgage market.

"From a process standpoint, loss mitigation is not going to change, but we could work on recidivism rates. Did it help some people? Of course it did. Would we go back to just like it was in 2004? There's no way," said Parker. "But we have to have a way to budget for it. We have to know what the costs are, and what the incentives or disincentives encourage or discourage in line with that."