Just the suggestion that California might suspend Ocwen Financial's license has led to a mass sell-off of the mortgage servicer's shares, so imagine how its operations and finances would be affected if the state makes good on the threat.

Industry observers say the embattled Atlanta servicer would likely have to farm out its large California portfolio to a third party, disrupting its relationship with borrowers in the state and depriving it of fees and cash flow on roughly $95 billion of servicing rights. In a worst-case scenario, Ocwen — historically an active acquirer of other lenders' servicing rights — would be so starved for cash that it would need to start unloading servicing assets, they said.

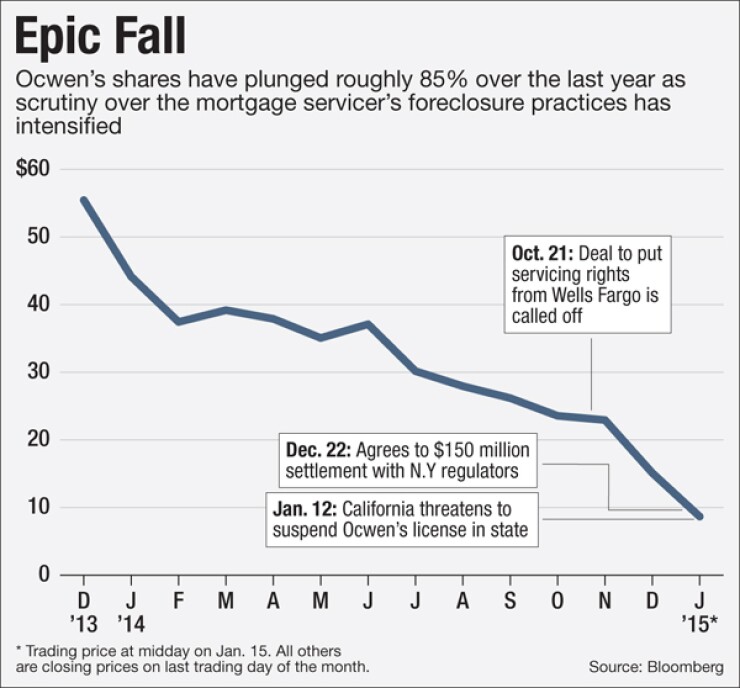

Ocwen's shares, which have already taken a beating over the last year, plunged nearly 50% earlier this week after a spokesman for California's Department of Business Oversight

It's yet another dust-up for a company that, in just the last several weeks, has come under heightened scrutiny from the national mortgage settlement monitor and was forced to pay $150 million to settle allegations in New York that it backdated thousands of foreclosure letters to distressed borrowers. As a condition of that settlement with New York's top banking regulator Benjamin Lawsky, William Erbey, Ocwen's founder and vice chairman, agreed to step down after 30 years with the company.

Ocwen-watchers say the firm's problems could largely have been avoided if the company had been more forthcoming with investigators.

"It's absurd that it's gotten to this point," said Ed Groshans, a managing director at Height Analytics, and a former Federal Reserve examiner. "It doesn't take a year for them to get the information together. The appearance is as if this is a nuisance rather than something that needs to be addressed."

"The company basically underestimated the wrath of the regulatory bodies," said Doug Kass, president of Seabreeze Partners Management, an asset manager in Palm Beach, Calif. "They should have resolved New York much sooner, and California much sooner."

Ocwen's shares rebounded somewhat Thursday, but they are still down roughly 85% over the past year. So what's next for the troubled company? A lot depends on whether California goes ahead and suspends Ocwen's license, most likely for a year, but that wouldn't occur until an administrative hearing in July. Here are three possible outcomes relating to California's threat.

Ocwen agrees to a settlement and fine in California

All things being equal, the state would prefer not to pull Ocwen's license because servicing transfers often result in complications for borrowers with loan modifications or in foreclosure. Therefore, a plausible scenario is that Ocwen responds to California's demands for documents and agrees to a settlement and fine,

"The main risk is if the regulator pulls their license and servicing," said Bose George, an analyst at Keefe, Bruyette & Woods. "Moving servicing is disruptive, foreclosure timelines lengthen and it's bad for distressed borrowers."

California's investigation of Ocwen dates back to early 2013 when the state's Department of Business Oversight began a routine exam. The state's formal notice of intent to suspend Ocwen's license for a year lists 14 separate requests for information over the course of a year, said Groshans.

The agency subpoenaed Ocwen in March 2014 asking that it show compliance with the state's Homeowners Bill of Rights, a series of laws passed to protect homeowners from foreclosure abuses. When Ocwen did not respond fully, the agency filed civil charges in October in a state administrative court to suspend Ocwen's license. A settlement conference has been scheduled for mid-February. And an administrative hearing is set for July, when a judge will ultimately decide whether Ocwen's license can be suspended or revoked.

"A settlement is always a possibility but at this point we're focused on making our case for suspension at the [February] hearing," Tom Dresslar, a spokesman for California's Department of Business Oversight, said in an interview with American Banker Wednesday. "Ocwen put out a statement claiming they are fully cooperating with our office and our response to that is the assessment does not comport with the record. We have a job to do as the regulator, we asked them for information and they have repeatedly failed to produce the information we asked for."

Ocwen's license is suspended for a year

If Ocwen does not agree to a settlement, and an administrative judge suspends Ocwen's license for a year, the company would be forced to hire a sub-servicer to take over the servicing of more than 378,000 loans in California, with an unpaid principal of $95 billion. California alone represents 23% of Ocwen's total servicing portfolio and transferring loans to a third-party servicer would result in a significant reduction in Ocwen's servicing fees.

One thing that's not clear is if there are subservicers big enough to handle the excess volume from Ocwen. Moreover, regulators have grown increasingly wary of loan

Some analysts expressed concerns that a license suspension would force Ocwen to sell the bulk of its servicing assets at fire-sale prices. Ocwen cannot just transfer individual loans, such as those in California, that are pooled in a securitization, Sandipan Deb, a director at Barclays, wrote in a research note Wednesday.

Ocwen also would be unlikely to buy out the loans since "it would seek to preserve liquidity for other purposes," Deb wrote.

There is a further fear that Ocwen could be in breach of private-label securitizations, which have triggers if delinquency rates reach too-high a level, or if a servicer's ratings fall. But trustees rarely pull servicing rights, partly because rallying enough bondholders to force a change in servicers is notoriously difficult.

It's worth noting, though, that California has never pulled servicing from solvent company, said Jason Stewart, an analyst at CompassPoint Research.

Ocwen sells more mortgage servicing rights to raise cash

As part of its settlement with New York regulators, Ocwen has been prohibited from acquiring additional mortgage servicing rights for at least a year, or unless if it gets approval from the New York Department of Financial Institutions. That prohibition has put a crimp in Ocwen's strategy, which has been to grow through acquisition.

But after the New York settlement was announced, Ocwen's president and Chief Executive Ron Faris said on a conference call that the company would sell some of its $1.7 billion in agency servicing rights, backed by Fannie Mae and Freddie Mac. The move would potentially free up $200 million to $300 million, Faris estimated.

Most of the agency loans were acquired when Ocwen bought servicing rights in 2012 from GMAC's Residential Capital Corp. "They were looking at a different return than they have now," said Groshans, who says the move was the result of heightened compliance costs from Ocwen's

Seabreeze Partners' Kass said the greatest risk facing Ocwen is that it will run short of cash, potentially triggering even more asset sales.

"The whole question is, 'what is the damage?' There's no evidence of it now, but if there were a lack of confidence, there is a risk of contagion just as there is with any financial institution that has some controversy around it," he said.

Ocwen has no short-term unsecured financing, said George at Keefe, Bruyette & Woods, adding that all of its financing is asset-based, backed by servicing advances or mortgage servicing rights, which can easily be sold.

"Ocwen has significant liquidity so a funding problem is very low-risk," said George.

But analysts at Barclays said Ocwen "may run into liquidity concerns," if it has to pay a substantial fine in California, or if additional state levy fines of their own as well. Another risk is if Joseph A. Smith Jr., the monitor of the $25 billion national mortgage settlement, finds serious breaches or violations in its reporting that "could cast serious doubt on the continuity of Ocwen's operations," they wrote in a research note this week.

Most analysts, though, think that is highly unlikely. Other nonbank servicers including