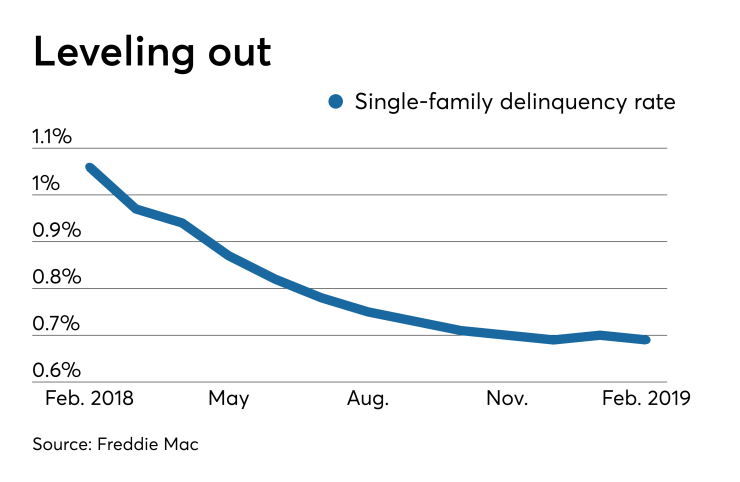

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

Freddie Mac's single-family delinquency rate dropped to 0.69% in February from 0.7% the previous month, returning to a level last seen in December 2018. A year ago, the government-sponsored enterprise's single-family delinquency rate was 1.06%. Its multifamily delinquency rate has been at 0.01% since last April, but it was slightly higher a year ago at 0.02%.

Freddie Mac recently announced it would be making

For example, the GSE recently launched a Servicer Honors and Rewards Program that will provide monetary awards, technology registrations, trophies or plaques to servicers that make tangible efforts to prevent cure delinquencies and have favorable performance scorecards.

Freddie Mac is planning to make the improvements to its servicing operations over the next three years.

It's unclear when the next downturn might occur, but some economists are concerned it could be approaching because the current expansion has been going on long enough to be due for a reversal. In addition, economic signals have been mixed to weaker.

For example,