Single-family rental loans lack consistent credit standards, and the secondary market opportunities for them are limited, Freddie Mac found in a preliminary test of expanded government-sponsored enterprise involvement in the sector.

“The single-family rental market is an important segment of the housing market and the data reveal it to be an affordable housing option for many American families,” said Steve Guggenmos, vice president of multifamily research and modeling, in a press release. “Much of the SFR market is primarily driven by small investors, and there is not a uniform set of terms and credit standards for loans on SFRs."

The Federal Housing Finance Agency

Single-family housing stock now represents more than half of the rental market overall, and two thirds of the market in rural areas, according to Freddie Mac.

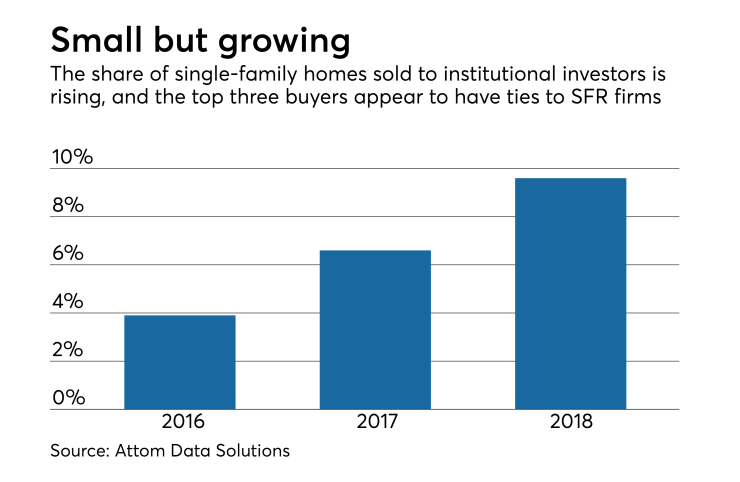

Most single-family homes remain owner-occupied, but a recent study of sales on two online real estate platforms suggests the share purchased by institutional investors that rent out homes is growing.

The percentage of institutional investor sales grew to nearly 10% from nearly 4% between 2016 and November of 2018, Attom Data Solutions' recent analysis of data from homeowner sales on Opendoor and OfferPad found.

"The top three institutional buying entities — Cerberus SFR Holdings LP, CSH Property One LLC and TAH Holding LP — all appear to be related to companies purchasing single-family homes as rentals," Attom noted.