Builder Taylor Morrison Home Corp. has launched a program that lowers the rate on its lending subsidiary's mortgages for two years through a new buydown program.

"While homeownership is attainable for many people, the uncertainty in not knowing what the future holds with respect to interest rates can cause real angst for today's buyers," Sheryl Palmer, Taylor Morrison's chairman and CEO, said in a press release. "We understand this impact and wanted to remove that barrier for our customers."

The program lowers the rate on fixed-rate mortgages by 2% for the first year and by 1% the second year, based on Taylor Morrison Home Funding's current market rate for 15- and 30-year conventional and Federal Housing Administration loans at the time of rate lock.

The offer began on Jan. 4 for move-in-ready homes that close on or before April 30. Borrowers must be buying owner-occupied houses, have a minimum credit score of 680, and use the closing agent selected by the seller.

"The buydown program is an excellent choice for many families and hasn't been widely used for some time," Tawn Kelley, president of Taylor Morrison Home Funding, said in the press release. "For a builder to offer this kind of financial incentive to ease the costs of mortgage interest, it can make a significant difference to a family's first years settling into their home."

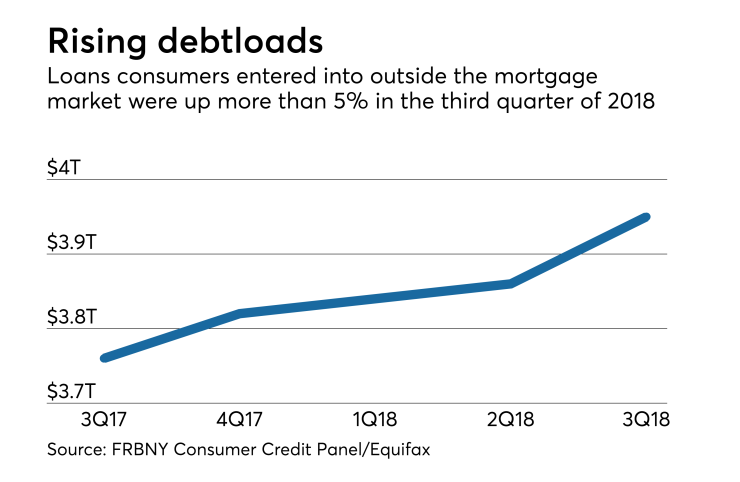

A combination of high levels of consumer debt, limited housing inventory, and relatively higher rates and

"It is a perfect solution for people who may be expecting a promotion or working on paying off a car loan or credit card balances, or just wanting the extra dollars to bolster their savings," Kelley said.