With mortgage rates expected to

Fannie projects the average rate to hit an even 4% for 2019 and drop to 3.8% for 2020. These are declines from the

"This month, escalating trade tensions and concerns about weakening global growth led us to revise lower our full-year 2019 and 2020 forecasts of real GDP growth to 2.1% and 1.5%, respectively," Doug Duncan, senior vice president and chief economist at Fannie Mae, said in a press release.

"Despite a strong start to the year, we expect growth to slow beginning in the second quarter as macro-level uncertainty disincentivizes business fixed investment and starts to weigh on consumer spending. In order to sustain the longest expansion in more than 70 years, we expect the Fed to once again begin easing monetary policy and to cut its interest rate target by 25 basis points in September."

The downshift in rates adds up to a heightened origination outlook through 2020, especially with refinances.

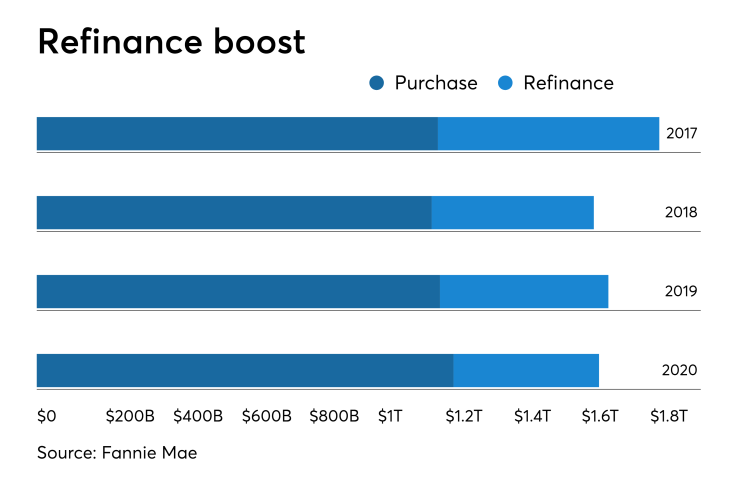

The government-sponsored enterprise's June forecast shows mortgage origination volume ended at a revised $1.64 trillion in 2018, which will jump to $1.68 trillion in 2019 before stepping back to $1.65 trillion in 2020. The projected volumes are boosts of $87 billion in 2019 and $16 billion in 2020 from Fannie's first-quarter estimates.

With lower rates on the horizon, the 2019 purchase total is projected to hit $1.19 trillion while the refinance volume sits at $494 billion — a 29% share. Purchase volume for 2020 forecasts at $1.23 trillion with the refinance total going to $428 billion, or a 26% share.

Total home sales are on a 1% incline trajectory in both 2019 and 2020. This year's total should reach 6.02 million units and hike to over 6.07 million in 2020. The total home sales for 2018 hit 5.96 million.

"We expect housing to add to growth for the foreseeable future, and our projection of a 1% year-over-year increase in home sales in 2019 remains unchanged," Duncan said. "Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as homebuilders are now paying more attention to the entry-level portion of the housing market."