After a strong February, existing home sales took a U-turn in March. While buyer conditions heated up and mortgage rates remained low, consumers took a patient approach — especially in the expensive West Coast markets.

"Sales have been volatile in 2019 thus far, but the average for the first three months of the year is around 5% lower than in 2018," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "We had expected this to be stronger, given the solid economy and job market, but the high end of the market has started to cool off, and the lower price tiers are still hampered by a lack of availability."

Low unemployment rates and increasing household incomes

"The first-time homebuyer share of sales was 33%, a slight improvement from 32% in February. Limited inventory of entry-level homes continues to slow would-be first-timers, but lower mortgage rates and moderating home-price growth should continue to support home sales in the coming months. We expect sales to pick up as long as more inventory comes onto the market," said Kan.

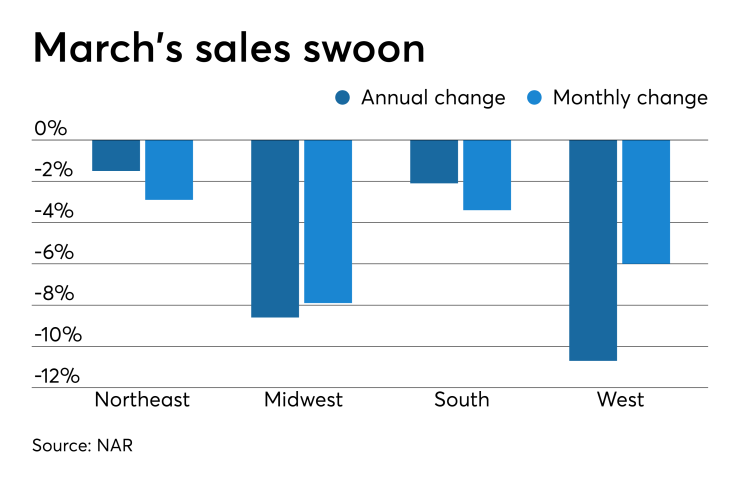

While March sales fell in each of the four major regions, they plummeted most in the West. Exorbitant prices driven by population influx of the recent past led to sales decreasing 10.7% annually and 6% month-to-month.

"

California accounted for seven of the 10 housing markets with the largest drop off in year-over-year sales, including Los Angeles at 19.4%, Orange County at 16.4% and Fresno at 16%.