The House of Representatives passed two bills that would tie appraisal requirements for Small Business Administration loans to bank regulators' requirements for all commercial real estate loans. But the plan has been met with opposition from the Appraisal Institute, which claims the SBA will take on unnecessary risk if its members are cut out of transactions.

Following a rule change by the Federal Reserve Board, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. earlier this year,

The bills, HR 6347, the 7(a) Real Estate Appraisal Harmonization Act, and HR 6348, the Small Business Access to Capital and Efficiency Act, would remove the current statutory $250,000 limit for SBA loan appraisal waivers and instead rely on the banking regulators' standards. Both bills passed on a voice vote taken on Sept. 25, but their fate in the Senate is unclear.

The higher thresholds would "virtually eliminate" the need to get appraisals for SBA 7(a) and 504 loans, the Appraisal Institute warned in a letter to House Speaker Paul Ryan before Tuesday's vote. And while banking regulators require CRE lenders to obtain property evaluations on collateral eligible for appraisal waivers, a similar requirement is not included in the SBA bills, the appraisal group said.

As a result, the bills "fail to fully align the SBA requirements with those of the federal bank regulatory agencies," the Appraisal Institute letter reads.

"Evaluations have specific development and reporting requirements smaller in scope than appraisals; however, the SBA does not require evaluations, and neither bill includes corresponding evaluation requirements," the group added.

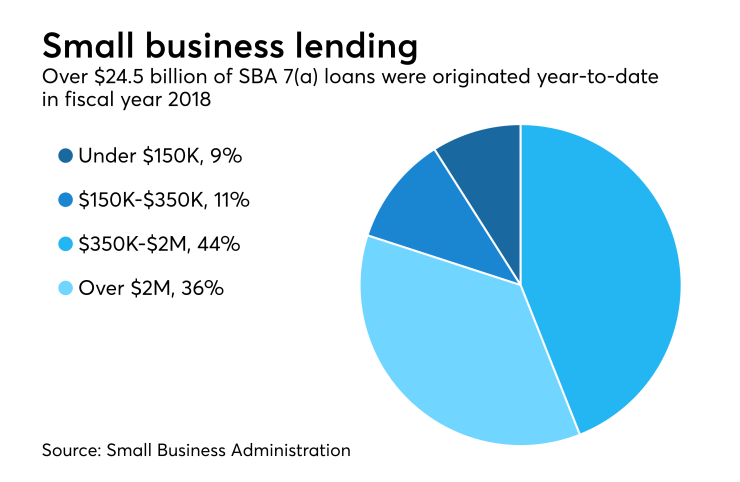

With about a week left in the 2018 federal fiscal year, the SBA has guaranteed more than 58,000 loans under the 7(a) program totaling over $24.5 billion. Meanwhile, nearly 5,800 loans totaling more than $4.6 billion have been guaranteed under the 504 program, according to SBA data.

In the 7(a) program, loan balances between $350,000 and $2 million account for 44% of total dollar volume. About 30% of the total dollar volume was for 7(a) loans over $2 million. In the 504 program, about 56% of the dollar volume went to loans between $350,000 and $2 million, and 34% of the dollar volume was for loans over $2 million.

The Appraisal Institute "is making a mountain out of a molehill" when it comes to the pair of bills, said Chris Hurn, CEO of Fountainhead Commercial Capital, an SBA 504 lender based in Orlando, Fla.

When it comes to risk, nonbank lenders like Fountainhead "are just as careful as any regulated entity. And we should be, or we will go out of business," Hurn said.

Even though he supports the legislation, Fountainhead will likely still get an appraisal on properties in transactions in the $300,000 to $400,000 range. "I just think it's a good best practice," Hurn said. "Part of good commercial real estate lending is making sure you understand what your collateral is worth."

Currently, the SBA does not require lenders to obtain property evaluations on loans exempt from appraisal requirements. But nothing in the current bills to raise the appraisal waiver threshold would prevent the SBA from requiring evaluations in the future, agency spokeswoman Carol Wilkerson said in an email to National Mortgage News.

By not specifying how SBA lenders should assess the value of collateral, the bills are "too broad because they are enabling any kind of valuation, they're not specific about a particular type of tool, whether it's an appraisal, whether it’s a commercial evaluation or even a broker price opinion," said Randy Fuchs, the principal at Boxwood Means, a Stamford, Conn., company that provides evaluations on small-balance commercial loans.

The goal of the bills is to reduce lender costs and reduce third-party borrower costs for small businesses trying to grow, Fuchs said. "We would hope further discussions about the legislation would refine it so that the minimal tool … would be evaluations."

A commercial property evaluation "is a rigorous, detailed analysis that may use the sales comparison approach and/or the sales and income approach" to determine a value, he explained. A BPO may just be a simple average of three comparable property valuations. Such valuations are not typically the core competency of the person performing them.

On the other hand, using appraisals for many of these loans "is like using a sledgehammer to kill a fly," Fuchs said. Commercial evaluations are more like using "a flyswatter," because they are more efficient and more cost-effective.

Commercial appraisal costs do not adjust based on the project size, so the costs are typically the same on a $300,000 deal as they are on a $3 million one, he noted.

Technology and data analytics can also provide reliable property valuations and keep risk in check, said John Moshier, the president of ReadyCap Commercial, an SBA 7(a) lender.

"We would get some type of evaluation done" if the bill passed, "but there are more cost-effective ways to do it out there," he said. "That's called prudent lending. In my mind you need to have some type of methodology to evaluate" a property's worth.

"You have to be a prudent lender, no matter what the regulations say, what the law says," Moshier said. The bills are "rightsizing" the SBA program with conventional commercial real estate lending when it comes to appraisal requirements.

Meanwhile, the National Credit Union Administration recently

Congress should not enact the legislation, the group said, "so that the evaluation and NCUA proposal can be studied further and addressed in clarifying amendments."