Atlantic Bay Mortgage Group has agreed to buy a majority stake in Virginia Community Bank in Louisa in a rare instance of a nondepository mortgage company buying a bank, rather than the reverse.

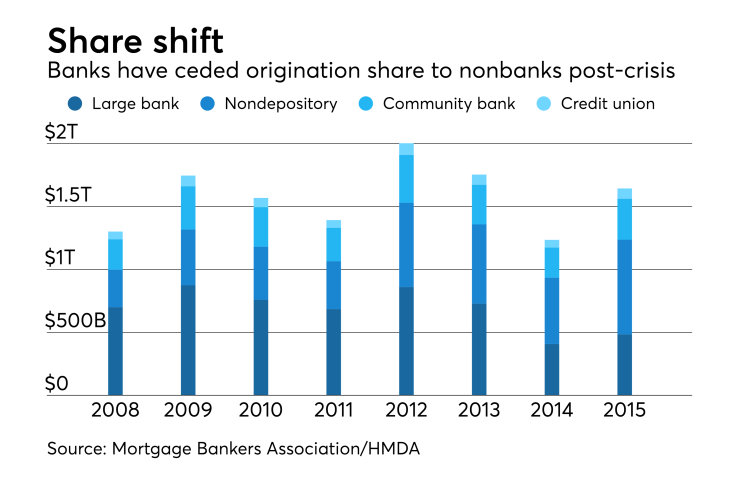

Many large banks are

Virginia Community's name will be replaced with Atlantic Bay's branding, except for the original bank branches. The all-stock deal is expected to close in the fourth quarter, when the parties involved also plan to complete a $20 million offering of common stock. Atlantic Bay's ownership would have a 60% stake of the bank, excluding the impact of any adjustments resulting from the planned common stock offering, the companies said.

The companies cited the ability to originate mortgages nationwide and streamline state licensing, as well as a lower cost of funding, as the reasons for the deal.

"Both of those are huge pieces of it," said Brian Holland, Atlantic Bay's CEO. He said there should be "significant financial savings" as the company transitions out of its reliance on warehouse lines for funding.

Atlantic Bay, which is based in Virginia Beach, also will be able to add products like home equity lines of credit and

The transaction also will bring capital to the bank that will allow it to grow, said Thomas Crowder, Virginia Community's chief financial officer.

"Our capital ratios will dramatically increase," he said.

When independent mortgage lenders and community banks merge, it's the mortgage unit that can end up generating the bulk of the revenue.

"We have seen amongst many mortgage bankers that are wholly owned or majority owned by a community bank, that 'the tail wagging the dog' is in full effect," Arthur Prieston, chairman of the Prieston Group, a consulting firm in Novato, Calif., said in an email. "The mortgage bankers represent a larger part of banks' profits, especially as Tier 1 banks are reducing their participation."

Nondepository mortgage lender acquisitions of banks have been rare recently, but they tend to become more common when nonbanks need greater access to less expensive funds. "This again [is] happening as the market continues to evolve," Prieston said.

For example, the CEO of the nondepository lender Movement Mortgage acquired the $29 million-asset First State Bank in a deal that

Banks with mortgage operations tend to have better valuations in the public market over the longer term than nonbank mortgage companies, Crowder noted. In the Atlantic Bay-Virginia Community combination, the company will operate as a bank with a mortgage unit.

The bank also is shedding its holding company as part of the transaction, which is in line

Brian Holland would become the bank's chairman, and Atlantic Bay Chief Operating Officer Stan Holland would become a member of the bank's board of directors.

Virginia Community CEO Preston Moore will retain his title and become Atlantic Bay Bank's CEO. Crowder also will retain his title.

While there will be some changes in branding and executive titles, there are no plans for cuts to staff or facilities.

Atlantic Bay's purchase of 100% of the bank's stock will give the nonbank's current members approximately a 60% ownership of the bank, excluding possible adjustments related to how the planned stock offering plays out.