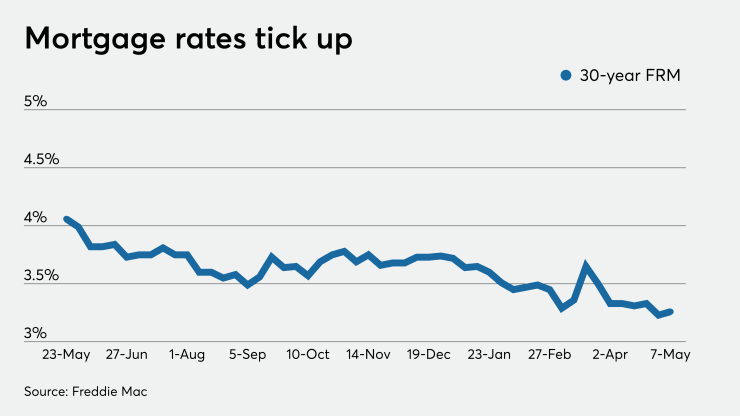

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

"Mortgage rates stayed at or near record lows for the fifth straight week and homeowners are taking advantage with refinance activity remaining high," Sam Khater, Freddie Mac's chief economist, said in a press release. "Although purchase demand declined 35% year-over-year in mid-April, demand has improved modestly over the last three weeks."

Zillow's tracker, which covers a broader segment of the market, reported similar movements in mortgage rates over the past seven days.

"But, as has been the case in recent weeks, these relatively easy borrowing conditions remain available largely only to those with a hefty down payment, high credit score and seeking a plain-vanilla loan," Zillow economist Matthew Speakman said in an accompanying statement.

"Because of persistent underlying uncertainty throughout the market, borrowers not meeting these criteria continue to be presented with much higher-than-expected rates when filing an application. More than 7.5% of outstanding mortgage loans are currently in forbearance — a program that allows the borrower to pause monthly payments, penalty-free, but that also limits short-term revenue prospects for lenders," he continued.

"What's more, lenders are finding it challenging to accurately quantify risk at a time when dramatic shifts in the economy are occurring seemingly every few days. So while average rates are likely to remain low for those who qualify, until there is more certainty in the broader economy, expect these spreads between rates to remain."

The 30-year fixed-rate mortgage averaged 3.26% for the week ending May 7, the Freddie Mac Primary Mortgage Market Survey reported,

The 15-year fixed-rate mortgage averaged 2.73%, down from last week when it averaged 2.77%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.57%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.17% with an average 0.3 point, up from last week when it averaged 3.14%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.63%.