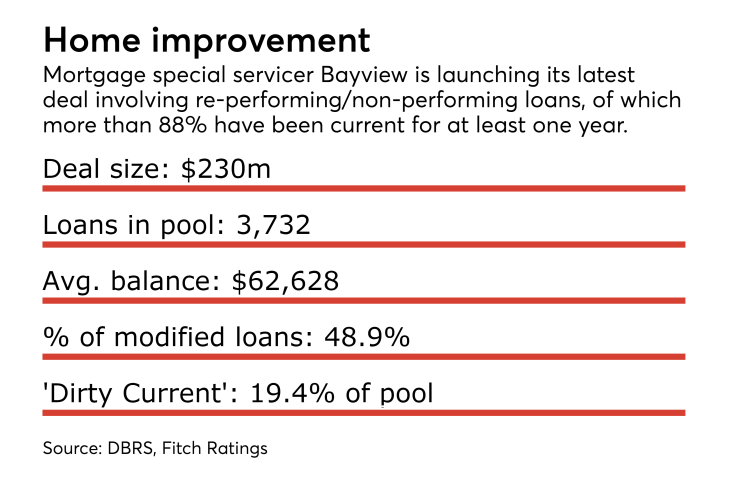

Bayview Loan Servicing is launching its 67th overall securitization of performing and reperforming loans in a $230 million transaction featuring more of the lower-valued homes in its $4.8 billion special servicing portfolio.

The Bayview Mortgage Fund IVc Trust 2017-3 portfolio consists of 3,732 seasoned performing and reperforming first-lien residential mortgages consisting of both fixed-rate and hybrid ARM loans. The loans have a total principal balance of $230 million, along with over $6.6 million in deferred principal amounts.

The $230 million in notes to be issued include six classes of long-term, fixed-rate notes along with several interest-only bonds.

Fitch Ratings and bond rating agency DBRS have assigned preliminary AAA ratings to the $153.52 million Class A tranche, which benefits from 33.25% credit enhancement. The Class A bonds carry a 3.5% coupon interest rate.

The company’s most

The loans are about 135 months (about 11 years) seasoned and all are current, with an average balance of $61,628, according to presale reports (that includes loans that emerged from bankruptcy, which make up 2.3% of the pool).

Nearly 88% of the loans have had no 30-day delinquencies in the past year, and nearly 81% for the past two years — meaning that 19.4% of the mortgages are “dirty current” loans with either a missed payment in the last 24 months or lacking records of a complete 24-month current payment history. About 49% of the mortgages have gone through one or more modifications.

The loans carry a weighted average coupon of 7.5%, with nearly 50% modified from weighted average original coupons of 9.1%.

The average home value of $117,000 is below the average $150,000 for other recently rated RPL deals, according to Fitch.

The sponsoring entity, Mortgage Fund IVc, will retain a 5% eligible vertical interest.

Of the 3,732 loans in the pool, 1,534 have non-interest-bearing deferred amounts equaling 2.9% of the total principal balance. These include proprietary principal forgiveness and HAMP principal reductions amounts. According to presales, 99.6% of the loans are not subject to the Consumer Financial Protection Bureau’s qualified mortgage rules.

Nearly 73% of the loans are daily simple interest, meaning the existing loan balances may not amortize by their scheduled maturity dates, if borrowers pay fixed monthly payments after the actual due date. Bayview is expected to extend the maturity for those loans at the scheduled maturity date — running the risk the transaction will have insufficient collateral to pay the bonds in full by the final maturity date in 2058.

Bayview will not be advancing delinquent payments of payments and interest.

Since 2012, funds managed by affiliates of Bayview Loan Services have issued these RPL and NPL securitizations. Bayview began servicing daily simple interest loans in 2000, and services about 99,000 loans.