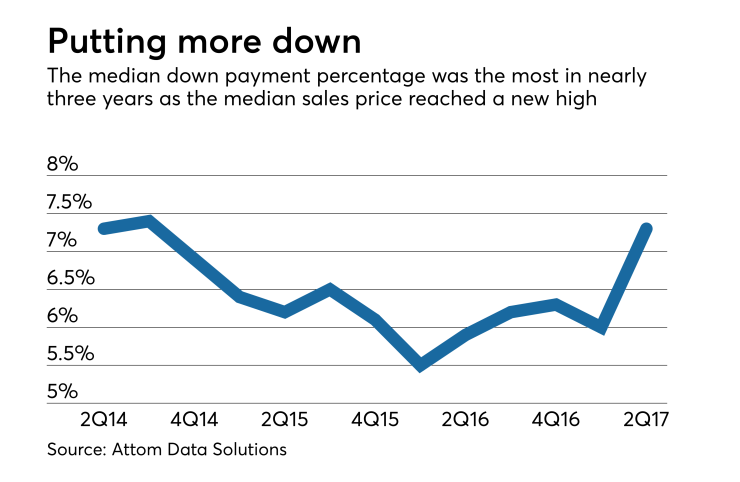

The median down payment for a home purchased in the second quarter was 7.3%, the most in nearly three years, a result of increased competition, according to Attom Data Solutions.

In terms of dollar amount, the $18,850 median down payment and the median home price of $259,000 was the highest since Attom started tracking data in 2000. The previous high for both was set in the third quarter of 2005, with a median of $18,000, which equated to a 7.1% down payment on a median-priced home of $255,000.

The increase in down payment percentage and dollar amount is a reflection of

It also runs counter to an increase in low down payment programs, such as Quicken, United Wholesale Mortgage, Guild Mortgage and most recently, Garden State Home Loans, that are offering products that require the borrower to put

The median down payment for a home was 6% in the first quarter and 5.9% in the second quarter of 2016.

An increase in the use of co-borrowers — which Attom defined as multiple, nonmarried borrowers listed on the mortgage or deed of trust — is being attributed to purchasers having to make a higher down payment to obtain the home.

Co-borrowers were used on 22.8% of purchase loan transactions in the second quarter, up from 21.3% in the previous quarter and 20.5% one year ago.

"Home buyers are increasingly relying on co-borrowers to help with home purchases, particularly in high-priced markets where sizable down payments are necessary to compete," Daren Blomquist, Attom's senior vice president, said in a press release.

"This rising trend in co-borrowing is helping to eke out increases in purchase loan originations despite affordability and supply constraints."

Among the 75 metropolitan areas with at least 1,500 purchases, the highest median down payment percentages were in San Jose, Calif., 25.2%; San Francisco-Oakland, 22.3%; Los Angeles, 19.3; Naples, Fla., 18.5%; and Oxnard-Thousand Oaks-Ventura, Calif., 17.4%.

The lowest median down payment for a home was in the Virginia Beach-Norfolk, Va.-area at 2%. The median down payments for homes in the Albany, N.Y., and Pensacola, Fla., areas were both at 2.1%, with Columbia, S.C., at 2.4% and St. Louis at 2.6%.