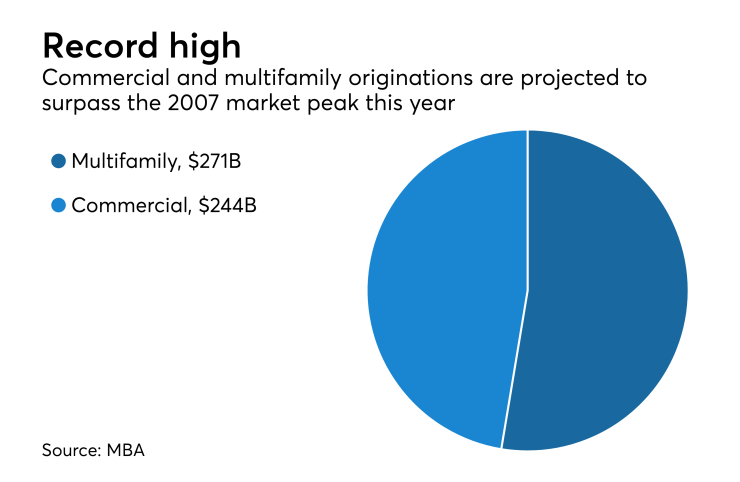

Commercial and multifamily originations should increase in 2017 to about $515 billion, an increase of 5%

The predictions on dollar volume of originations for the end of this year suggest 2017 will beat out the 2007 market peak of close to $508 billion in commercial and multifamily originations.

"Commercial and multifamily markets remain strong, even as many growth measures are exhibiting a bit of a downshift," said Jamie Woodwell, MBA vice president of commercial real estate research, in a press release.

"Property values are up 6% through the first eight months of this year. Despite a decline in property sales transactions, commercial and multifamily mortgage originations were 15% higher during the first half of this year than a year earlier. We expect stable property markets and strong capital availability to continue to support mortgage borrowing and lending in 2018," he continued.

Mortgage banker originations for multifamily mortgages should hit $235 billion this year, with total multifamily lending at $271 billion, according to MBA projections. Due to strong growth in 2017, multifamily lending is likely to slow next year.

Commercial and multifamily mortgage bankers originated $490.6 billion in closed loans in 2016, which became the third strongest year on record, behind 2015 and 2007.