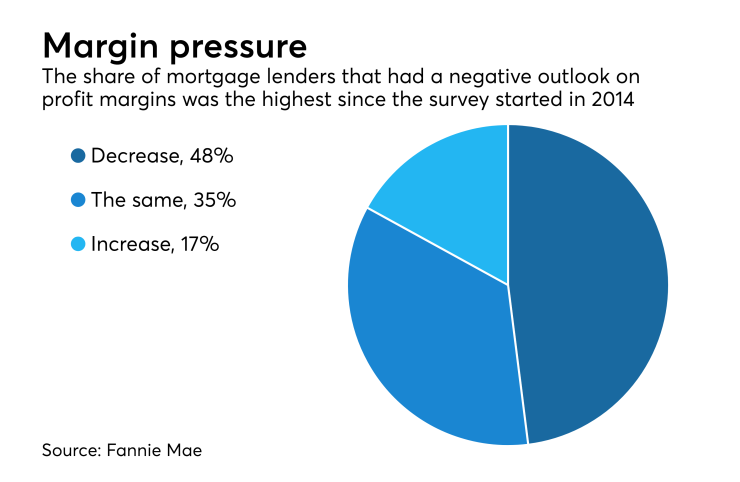

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

"Lenders have faced an increasingly difficult market environment, as they report the most sluggish refinance demand expectations in more than a year, the most anemic purchase demand outlook on record for any first quarter, and the worst profit margin outlook in the survey's history," Fannie Mae's Chief Economist Doug Duncan said in a press release.

Of the lenders surveyed, 48% expected a decrease in profit margins in the next three months. The previous high was in the fourth quarter of 2016, when 46% of survey participants had a negative opinion. In both the first and fourth quarters of 2017, 38% expected profit margins to go down.

Meanwhile, 35% of respondents expect profit margins to remain the same, while 17% expect them to increase.

Among lenders expecting a decrease in margins, 78% cited competition as a key reason while 35% cited the shift from refinances to purchases. A decline in consumer demand was cited by 22%.

On the other hand, for those that expected an increase in profit, 43% cited operational efficiencies, while 41% cited the shift from refi to purchase loans. Respondents were able to cite more than one cause in the survey.

For conforming purchase loans, 9% more lenders as demand decline, while 14% more saw demand for government purchase loans decrease.

For non-GSE-eligible loans, there was an equal split between those reporting increased demand and decreased demand.

While purchase mortgage share could rise going forward, most respondents expect refi demand to dwindle for all types of loans.

Although dwindling volumes and competition are weighing on lenders' profit margins, there are signs they are holding the line on underwriting.

"Despite the pressures to remain competitive and profitable, signs of lender caution appear to be emerging," Duncan said. "While more lenders eased lending standards than tightened them, continuing the trend that started more than three years ago, the net share of lenders reporting

Fannie Mae started the quarterly Mortgage Lender Sentiment Survey in March 2014.