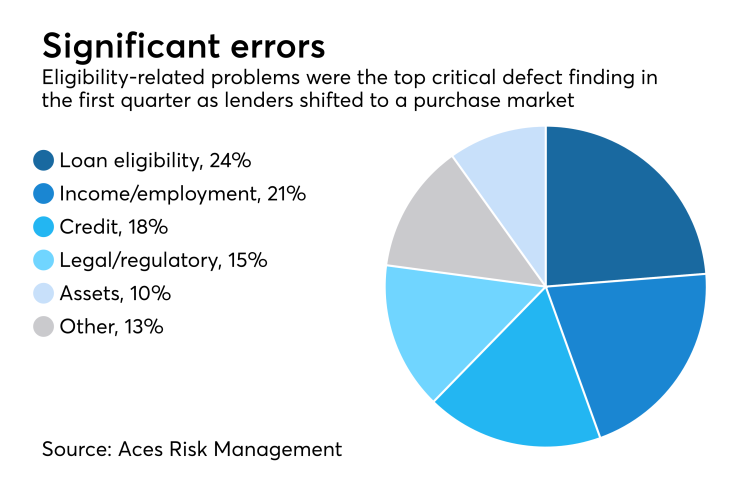

Borrower and mortgage eligibility problems, a sign of the shift to a purchase market, were the leading cause of critical defects found following post-closing reviews, according to Aces Risk Management.

Almost 24% of closed loans reviewed had this type of defect, followed by 21% which had defects in income and employment verification and 18% that had credit issues. The defects are classified using the Fannie Mae taxonomy. A critical defect is defined as one that would render the loan ineligible for purchase in the secondary market.

Critical defects were found in 1.61% of all closed loans in the first quarter, compared with 1.5% in the fourth quarter and 1.92% in the first quarter of 2016. Lender errors related to TILA/RESPA Integrated Disclosure implementation was the

"Purchase transactions bring a lot more moving parts, and a lot more opportunity for errors and misrepresentations," said ARMCO President Phil McCall in a press release. "Whether that rate continues to rise will depend in large part on the ratio of purchases to refinances as we move forward."

Over 87% of all critical defects found with borrower and mortgage eligibility were a result of loan product and/or guideline issues as lenders expanded their product offerings. Additional underwriter training and process improvement is needed to fix this issue, ARMCO said.

Legal and regulatory compliance errors were found in 50% of mortgages with a critical defect closed in the first quarter of 2016, which was attributed to TRID. But only 15% of loans closed in the first quarter of 2017 had a critical defect associated with legal or regulatory compliance errors.

Conventional loans were 53% of closed loans in the first quarter and Federal Housing Administration-insured loans had a 31% share. But when it came to loans with critical defects closed during the period, over 52% were FHA loans and 36.5% were conventional.