All three major forecasters of mortgage activity have slashed their 2022 originations outlook because of rising interest rates and

The Federal Reserve will not be able to navigate a "soft landing" for the U.S. economy and a recession is possible for 2023, but not similar in magnitude or duration to 2008, Fannie Mae's chief economist, Doug Duncan, said in a press release.

"Mortgage rates have ratcheted up dramatically over the past few months, and historically such large movements have ended with a housing slowdown," Duncan said. "Consequently, we expect home sales, house prices, and mortgage volumes to cool over the next two years."

With rising rates, the inventory problem is not likely to be solved as borrowers with a 3% 30-year fixed rate mortgage are unlikely to give that up to purchase a new house — and put their old one on the market —

Slightly more than half of all people with a mortgage on their home, 51%, have a rate under 4%, Redfin said. Including people who don't owe anything on their home, this is 32% of the housing market.

Higher rates are affecting both supply and demand. "That slowdown in demand may cause homes to stay on the market longer, in effect giving buyers more options to choose from," Taylor Marr, Redfin's deputy chief economist, said in a press release. "Overall, that could mean housing inventory actually gets better, not worse."

However, this year should still set a record for purchase originations. Freddie Mac, which only issues quarterly forecasts, increased its predictions for purchase volume to $2.096 trillion from $2.07 trillion

"While the sharp increase in mortgage rates will lead to a precipitous drop in refinance originations in 2022, demand for housing continues to remain solid, propelled by the large swath of first-time homebuyers and prospective purchasers looking to lock in a mortgage rate before they increase further," Sam Khater, Freddie Mac chief economist, said in a press release.

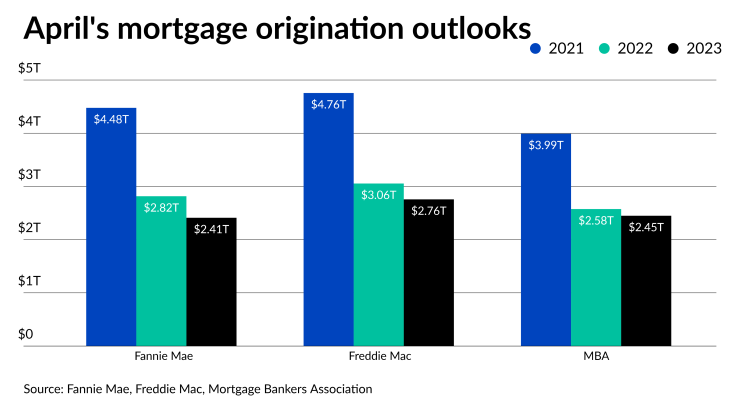

But Freddie Mac now predicts $3.06 trillion in total volume in 2022, down from $3.27 trillion in January, as it dropped its refinance prediction to $960 million from $1.2 trillion.

Fannie Mae now expects $2.82 trillion of total volume, with $1.93 trillion from purchase and $889 billion from refinancings. In March, it forecasted $2.98 trillion for this year, consisting of $1.95 trillion of purchase originations and $1.04 trillion of refis.

The Mortgage Bankers Association is calling for $1.72 trillion in purchase volume in its latest forecast, down from $1.77 trillion in March. Total volume should be $2.58 trillion this year, a change from the $2.63 trillion projection of last month.

Refis in the MBA forecast are at $841 billion this year, $20 billion lower than the March outlook.

"Higher home prices and rates as well as ongoing supply constraints are now expected to lead to an annual decline in existing home sales," said MBA Chief Economist Mike Fratantoni in a press release. "Even though existing sales volume will be slightly lower than last year, the continued growth in new home sales and the swift rise in home prices should deliver a smaller, but solid, 4% annual growth in purchase origination volume."

However, First American Chief Economist Mark Fleming is more bullish on the current housing season, saying a more apt comparison for current market conditions is with March 2019.

"In March, the market potential for existing-home sales based on fundamentals was estimated to be 5.97 million at a seasonally adjusted annualized rate, down 3.2% compared with February, and 3.9% lower than one year ago," said Fleming in a press release. "Yet, the market potential for home sales remains 8.6% above March 2019, the start of the last full spring home-buying season before the pandemic hit."

On the negative side, average tenure in one's home

Going forward, Fratantoni is projecting record years for purchase production ahead, rising to $1.77 trillion next year and $1.85 trillion in 2024. While that prediction features reduction from the $1.85 trillion he previously forecast for 2023, it reflects an increase from the $1.78 trillion predicted for 2024.

Freddie Mac also expects 2023 to be another record year for purchase originations, rising to $2.22 trillion. This is an increase over the January forecast of $2.21 trillion.

Fannie Mae's Duncan, on the other hand, believes purchase volume will fall next year, to $1.85 trillion. He previously expected purchase activity to rise to 1.98 trillion in 2023. Fannie Mae and Freddie Mac have not released a 2024 outlook.