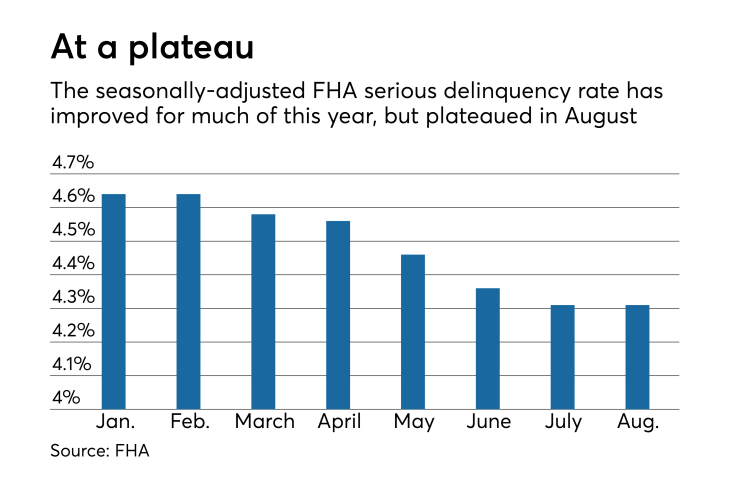

Serious delinquencies on Federal Housing Administration loans popular among first-time home buyers with affordability constraints have improved this year, but may be reaching a plateau.

Loans 90-days delinquent, in foreclosure or involved in bankruptcies remained stable at 4.31% in August. The seasonally adjusted estimate was 5.2% a year ago.

Even though delinquencies have been improving, FHA loans continue to make up

FHA product makes up about 17% of new originations but one-third of the distressed loans in the market, Altisource's analysis of FHA and Black Knight data shows.

While the FHA share of distressed loans is up, compared to the crisis the amount of distressed FHA product remains low, noted James Harp, director of real estate auction services at the company.

"I think the volumes have come down significantly," he said. "It no longer makes sense for servicers to maintain large staffs."

As a result, "a single vendor is becoming really appealing to servicers who previously wanted to diversify their vendor base," Harp said.

More than 70% of mortgage servicing professionals surveyed predict that the volume of loans that the FHA and the Department of Veterans Affairs insure at their organizations will increase in the next 12 to 24 months, according to the Altisource study, which the company released in September.

Independent research firm Ebiquity conducted the survey of 205 professionals in the mortgage default servicing industry for Altisource between June 22 and 29.