When the government-sponsored enterprises began purchasing mortgages with down payments as low as 3%, there was concern that Fannie Mae and Freddie Mac would expose themselves to greater credit risk.

If so, it hasn't shown up in Freddie Mac's numbers yet.

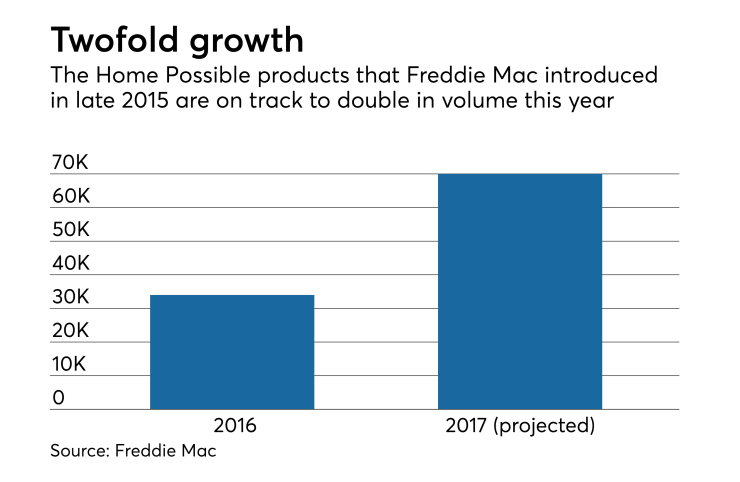

The GSE's delinquency rate keeps setting new records for post-crisis lows even as its volume of low down payment Home Possible loans has doubled in the past year.

"We are now expanding access to credit responsibly," CEO Donald Layton said during a conference call to discuss Freddie's second-quarter financial results. The GSE generated $1.7 billion in net income for the second quarter, down from $2.2 billion

Freddie Mac expects to pay a $2 billion dividend to Treasury by the end of the third quarter, but noted in new language in its earnings statement that whether it follows through with that depends on

Freddie's serious delinquency rate for single-family loans dropped to 0.85% in the quarter, down 23 basis points from the same quarter a year ago and 7 basis points from the first quarter.

At the same time, Freddie is on track to purchase 70,000 Home Possible mortgages by the end of this year, nearly double the number of low down payment loans it bought in 2016, Layton said. First-time home buyers account for about 80% of Home Possible loans, and the market segment is a key source of purchase mortgage lending and a means for Freddie to fulfill its affordable housing mandates.

"Clearly there's more risk in this kind of product, but if you look at the overall macro-economic conditions in terms of inventory, property values and the conservative way even these loans are underwritten, I think the risk is pretty minimal," said David Lykken, president of consulting firm Transformational Mortgage Solutions. "I would support these kinds of programs because this is what's going to get people into homes."

But whether Home Possible volumes will continue to grow and delinquencies continue to decline remains to be seen. To create a "responsible, sustainable homeownership opportunity," later this year, Freddie will stop buying 3% down payment mortgages from lenders that

Despite the increased volume of Home Possible loans, the product still only accounts for 5% of all purchase mortgages that Freddie buys from lenders. Low down payments have less impact on performance when home prices are appreciating. And the higher loan-to-value ratio products, introduced in late 2015, haven't been through their peak default period yet.