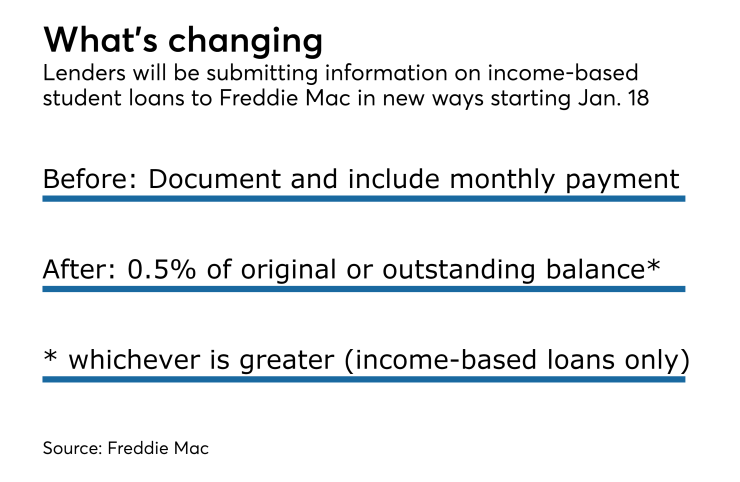

Freddie Mac is revising the way lenders need to submit payment information on certain student loans in order to calculate a borrower's monthly debt-to-income ratio.

Right now, when a monthly payment is not reported on the credit report lenders must obtain documentation verifying the monthly payment amount included in monthly debt-to-income calculations.

Starting Jan. 18, the government-sponsored enterprise is removing that documentation requirement and requiring lenders to use instead the greater of 0.5% of the original loan balance or outstanding balance.

In contrast to traditional amortizing student loans, monthly income-based student loan payments are not available on credit reports.

Income-based student loans also have payments that adjust each year, which makes payment shock a risk for borrowers who have them.

Freddie took that risk into account in making the change.

"Our revised requirements continue to permit the use of the reported payments for student loans with fully amortizing monthly payments while also providing a solution for evaluating student loans in income-driven repayment plans," according to a bulletin announcing the change late Wednesday.

"By requiring the use of a minimum payment of 0.5% of the original loan balance or outstanding balance, whichever is greater, the risk of the potential payment shock from the monthly payment increasing after the annual recertification is reduced; however, the borrower is still given the benefit of using a lower monthly payment amount than would be required under the traditional fully amortizing repayment plan."

Also changing at Freddie Mac is the way lenders report information on student loans that are either deferred or have forbearance in situations where the monthly payment amount is not documented.

Currently, when there is no documentation of the monthly payment, 1% of the outstanding balance gets considered as the monthly amount.

Going forward, student loans that are either deferred or have forbearance and don't have a monthly payment recorded on a credit report must use the greater of 1% of the original loan balance or the outstanding balance for qualification purposes.