While loan modifications are bringing much needed assistance to borrowers who exited forbearance in recent months, the impact of the relief is coming in well below targets laid out by federal officials.

In a new report, researchers from the RADAR Group at The Federal Reserve Bank of Philadelphia said “with recent interest-rate increases, average payment reductions have decreased significantly and are now below program targets for most borrowers.”

Struggling borrowers with mortgages guaranteed by government-sponsored enterprises Fannie Mae or Freddie Mac or the Department of Housing and Urban Development were able to opt into deferral and loan-modification programs at the end of their forbearance if they could not return to making regular payments. Modifications from the GSE flex program were meant to lower monthly principal and interest payments, or P&I, by an average of 20%. For the Federal Housing Administration program, the hoped-for payment reduction was set at 25%.

But the 2022 acceleration of mortgage rates, with

Among eligible borrowers in the Federal Housing Finance Agency’s GSE program, only a 23% share would be able to meet the target with the new 5% modification interest rate that went into effect on May 13, the RADAR group found, while the HUD-guaranteed program would fare slightly better, with 34% hitting the mark.

Also hampering P&I reduction for the GSE modification program is the limit to the allowable deferral of principal balance. Program regulations prohibited that amount from exceeding a minimum loan-to-value ratio of 80%. The past year’s

Philadelphia Fed researchers determined that if borrowers were not subject to the LTV restriction, 98% of borrowers would meet the reduced P&I target, with an average 36% decrease, even when taking into account rules prohibiting deferrals of no more than 30% of unpaid balance.

The introduction of HUD’s FHA COVID-19 recovery modification based on

“If the 40-year term gets adopted in June, 90% of FHA mortgages will meet their targets,” the report said. “Thus, a big factor in the success of the FHA program will be how soon servicers start extending mod terms to 40 years.” The average P&I reduction for HUD-guaranteed borrowers in the program would increase to 26%, Philadelphia Fed researchers predicted.

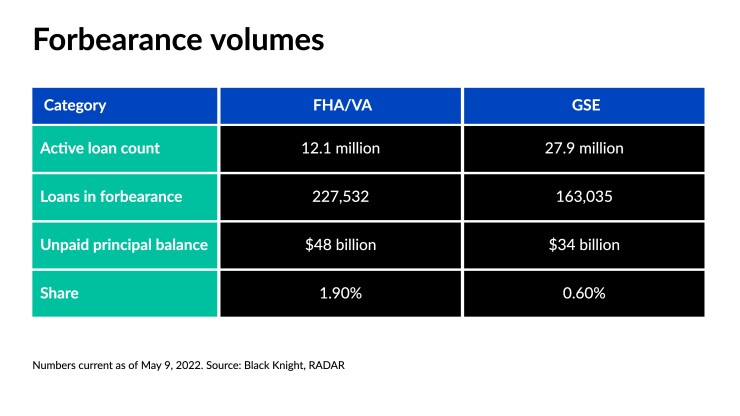

U.S. homeowners were able to enter into forbearance plans with a declaration of hardship upon the onset of the COVID-19 pandemic in 2020 thanks to the CARES Act. Of the more than 8.5 million in forbearance at some point over the last two years, 16% have not yet returned to making payments, according to

Borrowers who exited forbearance also had the option of resuming regular payments instead of a loan modification, with any missed amount paid back in a lump sum, either through a repayment plan, or with a deferral or partial claim. The total amount of missed payments would be put into a noninterest-bearing lien to be settled when the mortgage is settled. Approximately 30% of forborne borrowers have chosen that option.