HomeStreet in Seattle is making more cuts to its mortgage business.

The $7 billion-asset company said in a press release Wednesday that it will close 18 mortgage offices and reduce space in a regional processing center. It said it expects to fire 127 people, or roughly a tenth of the employees in its mortgage business.

The moves should save HomeStreet $13.1 million annually.

The offices are in Arizona, California and Washington.

The cuts reflect “several quarters of single-family mortgage market challenges that have reduced loan origination volume and profit margins,” HomeStreet said.

HomeStreet said the purchase market has slowed due to an ongoing housing shortage, while refinancing demand has declined because of rising interest rates. Profit margins are getting pinched because of competitive pressure and higher demand for jumbo nonconforming and high-balance conforming loans that reflects rising property values.

“The market conditions, cost structure, and product mix of these offices have changed dramatically since we entered these markets,” Mark Mason, HomeStreet’s chairman, president and CEO, said in the release. “By reducing expenses and consolidating offices in some markets and exiting other markets, we believe that we will be able to improve the profitability of our mortgage banking segment while also allowing us the ability to maximize our opportunities in our core markets.”

HomeStreet said it expects to record a $6.5 million pretax charge in the second quarter to address lease terminations and the write-off of fixed assets and tenant improvements at 11 mortgage offices. It plans to record another $2.9 million in charges during the third quarter tied to seven more closings and severance.

The company had already cut 107 mortgage jobs in the past year, including

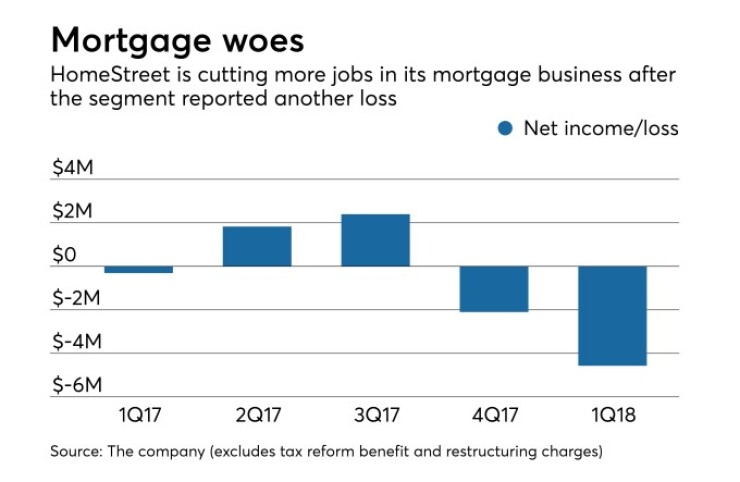

HomeStreet's mortgage banking segment reported a $4.3 million first-quarter loss.

A focus on mortgage and acquisitions has drawn the ire of Blue Lion Capital, which owns about 6% of HomeStreet's stock. HomeStreet has bought four banks since late 2013.

Blue Lion had planned to nominate two candidates for HomeStreet’s board and submit a proposal to separate the chairman and CEO roles. HomeStreet invalidated the investor's paperwork in a decision that a court recently upheld.

The investor continued to push for change, urging shareholders to reject two of HomeStreet’s director nominees. It also encouraged shareholders to vote against a nonbinding advisory proposal on executive compensation. The effort