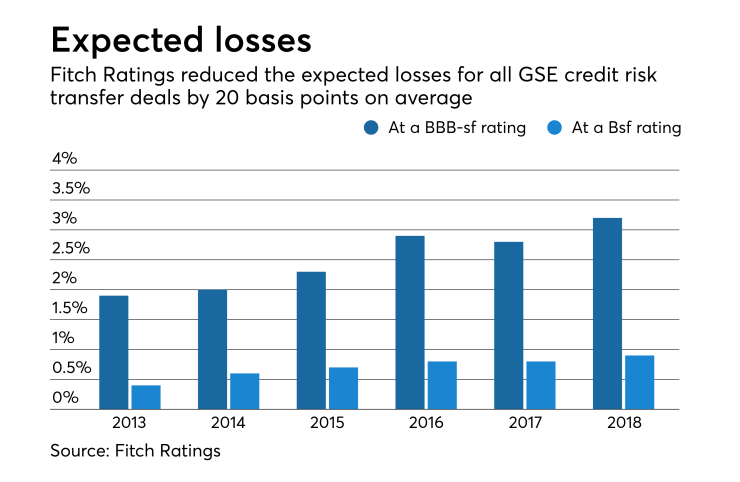

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise

The ratings agency revised the projected losses on Fannie Mae Connecticut Avenue Securities and Freddie Mac Structured Agency Credit Risk pools, using a stress test for a BBBsf rating, downward by an average of 20 basis points. At the AAAsf rating stress level, projected losses on these pools were revised downward by an average of 75 basis points, Fitch said.

Delinquencies on these pools have increased and the newer pools' early late payment trends are on a higher trajectory than at the same point for older transactions, the Fitch report said.

"However, performance generally remains strong and better than initial expectations, even for recently issued transactions," the report written by analysts Ryan O'Loughlin and Court Lake said. Among transactions with at least 12 months' seasoning, the average 60 days or more delinquency rate for transactions that include mortgages with a 60% to 80% loan-to-value ratio is 35 bps, with no pool higher than 76 bps. For CRT transactions with loans in the 81% to 97% LTV range, the average delinquency rate is 69 bps, with no pool higher than 112 bps.

Another reason for the revised loss projections is the increase in home values since the start of 2018. "Home prices in the respective pools have increased on average 20% since issuance and 3.5% since the prior review in January," the Fitch report said. "Consequently, the lower mark-to-market LTV ratios of the reference pools have driven current loss expectations lower relative to deal closing."

The increase in home values has resulted in higher than expected cancellations of private mortgage insurance. "For borrowers who are eligible to cancel but have not yet done so, Fitch increased the haircut to the MI benefit to reflect the possibility that they could cancel sooner than the model currently expects," the report added.

As for loans in areas hard hit

In addition, because these CRT transactions have a finite life of either 10 or 12.5 years from issuance, as they move closer to their maturity date, "Fitch applies a larger adjustment to projected losses to reflect the smaller window for future credit events," the report said.

Fitch reviews its rated CRT transactions every six months.