Mortgage applications fell again as the dearth of new and existing housing inventory continues to take a toll on the market.

The overall index stayed mostly static with a 0.2% decline after dropping 2.5% last week, according to the Mortgage Bankers Association. The seasonally adjusted and unadjusted purchase index both decreased 1% from

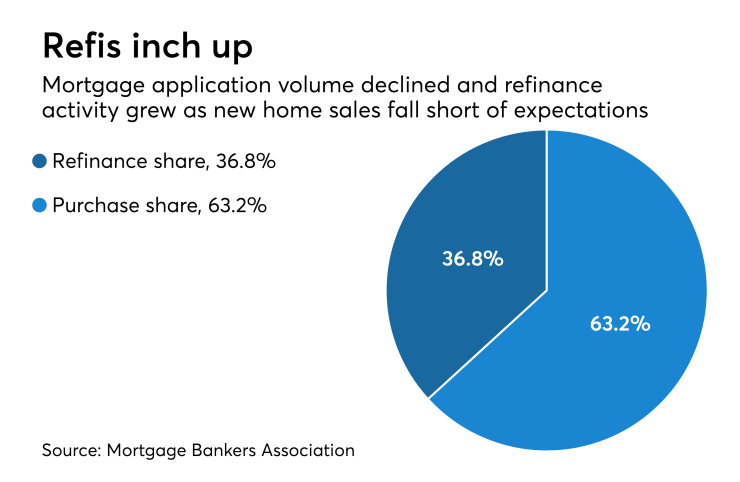

While total applications fell again, the refinance index rose 1% for the week ending July 20. The refinance share of application activity went to 36.8% from 36.5% as it continues to gradually dig out of the 18-year low from

"The refinance index increased for the second straight week as the 30-year fixed rate stayed flat, but this uptick was once again driven entirely by conventional refis, which increased 1.8% compared to a 3.8% drop in government refis. Purchase apps decreased 1% to their lowest level since May, as tight inventory continues to hold back home buying, but the index remained 2.2% higher than a year ago," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

The latest report from the U.S. Census Bureau corroborates the weakness in overall application activity, showing tepid

"New-home sales for June came in well below expectations, highlighting the slight weakening the housing market has experienced so far this year. Not enough residential investment, and added pressures from the lack of new and existing inventory on the market, have contributed to this ongoing flattening of sales despite the robust economy," said Freddie Mac Chief Economist Sam Khater in a statement.

Adjustable-rate loan activity increased to 6.3% from 6.1% of total applications. The share of applications for Federal Housing Administration-guaranteed loans fell to 9.9% from 10.6%, Veterans Affairs-guaranteed loans held at 10.2% and U.S. Department of Agriculture/Rural Development bumped back up to 0.8% from 0.7%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained at 4.77%. The average for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) increased to 4.72% from 4.66%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA stayed unchanged at 4.78%. The average for 15-year fixed-rate mortgages stepped up to 4.23% from 4.22%.

The average contract interest rate for 5/1 ARMs dropped 3 basis points to 4.09%.