It is important for lenders to understand in what locations and property types their application fraud risk rests as the

Florida, with its high concentration of condominium properties, is of particular concern to First American Financial's Chief Economist Mark Fleming.

While the First American Loan Application Defect Index was unchanged from December at 83, the purchase component rose to 92 from 91. That represents the highest the purchase risk has been since November 2014.

"As the risk of fraudulent purchase transactions rises, understanding where risk lies is important," said Fleming in a press release. "Florida is one of the largest markets in the country with concentrations of condominiums in the large coastal markets. The combination of size and rising defect, fraud and misrepresentation risk in condominiums, makes Florida an important market to watch."

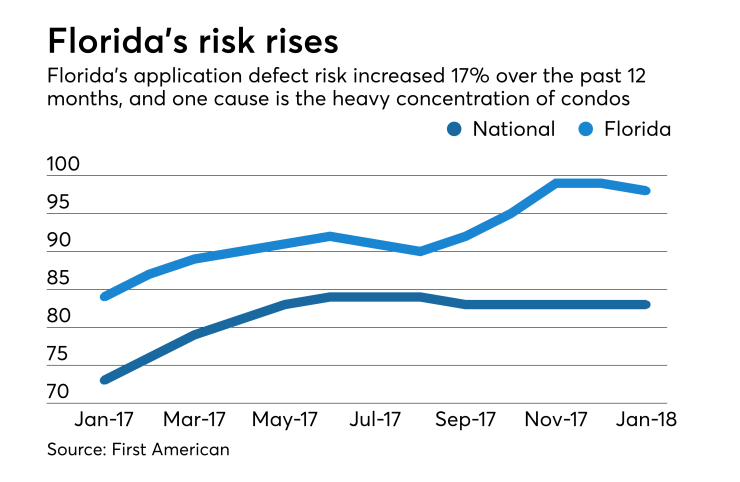

Defect risk in Florida, while down 1% from December to 98, has increased 6.5% since September 2017. The risk index in the state has increased 16.67% over the previous 12 months.

Fleming previously tied the increased fraud application risk in Florida to

"Florida is currently the third riskiest state according to the defect, fraud and misrepresentation risk index, and by far the largest state among the five most risky. The other states in the top five are Arkansas, Idaho, Wyoming and North Dakota," said Fleming.

"This may be partly driven by the popularity of high-rise condominiums in Florida's large coastal metropolitan areas. Condominiums are the only property type for which defect, fraud and misrepresentation risk has increased in the last three months, up 1.1% nationally."

For January, the index for condo mortgage loan apps was 88, second only to multiunit properties at 102. The index for planned unit developments was 84 and for single-family homes it was 83.

January's refinance application defect index was unchanged from December at 69.

In January 2017, the overall risk index was 73, with the purchase component at 83 and the refinance component at 59.

Among the five markets with the highest risk index in January, three were in Florida: Miami at 104, Cape Coral at 101 and Lakeland at 99. The only markets with a higher index were Little Rock, Ark., at 110 and Boise City, Idaho, at 105.