An increase in mortgage rates is actually a sign of a healthier economy, so growth in household income helps to offset the rise in rates. A much greater hurdle for homebuyers is limited home inventory, which is keeping potential homeowners out of the market and putting upward pressure on house values.

"Homebuyers can adjust to higher mortgage rates by substituting a lower adjustable-rate mortgage for the fixed-rate mortgage or buy a less expensive home. In other words, the housing market is flexible and can adjust to moderately higher mortgage rates without significant impact," said Fleming.

"The likely rise in mortgage rates is not the worry for first-time homebuyers, but whether they can find something to buy in today's supply-constrained market," he said.

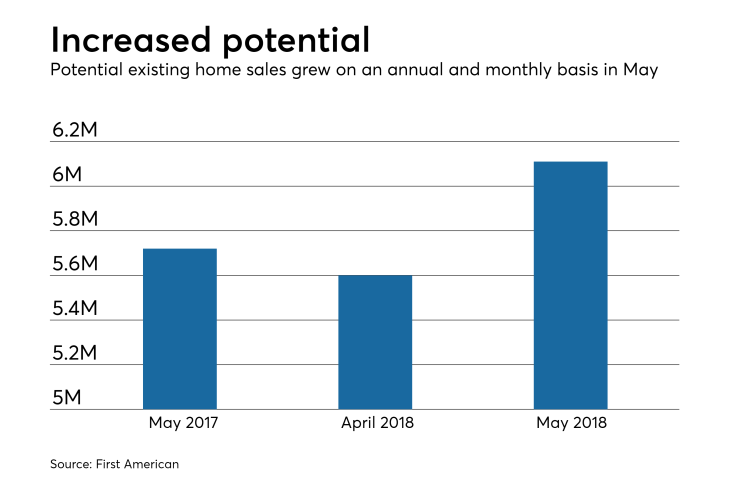

Potential existing home sales grew 4.4% year-over-year and 0.8% month-over-month in May to a 6.11 million seasonally adjusted annualized rate, according to First American's Potential Home Sales Model. The housing market is currently underperforming its potential by 289,000 sales.

"If the 30-year, fixed-rate mortgage rate increases to 5%, which most economists agree is likely by the end of 2018 or early 2019, the impact on the market potential would be a modest decline to 6.1 million existing home sales, according to the model," Fleming said.

While the recent increase in rates may not be as strenuous on the housing market as tight supply, inflation may be a future cause for concern.

"While federal funds rate hikes don't directly drive up the yield on the 10-year Treasury, higher inflation expectations certainly do," said Fleming. "The Fed's decision to raise rates for the sixth time in a year and a half was primarily viewed by experts as a reaction to the possibility of higher inflation due to continued improvement in the labor market and economy in general."

"As long as economic fundamentals remain positive, it is reasonable to expect greater concern about inflation, which will likely influence the 10-Year Treasury to move higher and mortgage rates along with it. The Fed is also likely to increase the federal funds rate in response to inflationary concerns," he added.