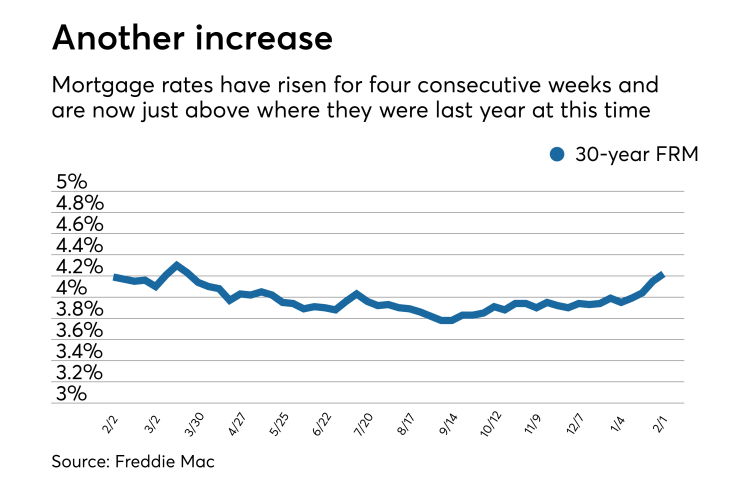

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.22% | 3.68% | 3.53% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

The 30-year fixed-rate mortgage averaged 4.22% for the week ending Feb. 1,

"The Federal Reserve did not hike rates this week, but the market views future hikes as a near certainty," Len Kiefer, Freddie Mac's deputy chief economist, said in a press release. "The expectation of future Fed rate hikes and increased borrowing by the U.S. Treasury is putting upward pressure on interest rates. The 30-year fixed rate mortgage is up over a quarter of a percentage point (27 basis points) from the first week of the year."

The 15-year fixed-rate mortgage this week averaged 3.68%, up from last week when it averaged 3.62%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.41%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.53% this week with an average 0.4 point, up from last week when it averaged 3.52%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.23%.

"Each new wave of economic data points to a tight labor market and steady gross domestic product growth," Aaron Terrazas, Zillow's senior economist said when that company released its own rate tracker on Wednesday. "These rosy fundamentals, combined with the larger federal borrowing as a result of tax reform, are putting upward pressure on mortgage rates. This week markets will watch Friday's January Jobs Report for continued employment gains and signs of wage growth."