Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

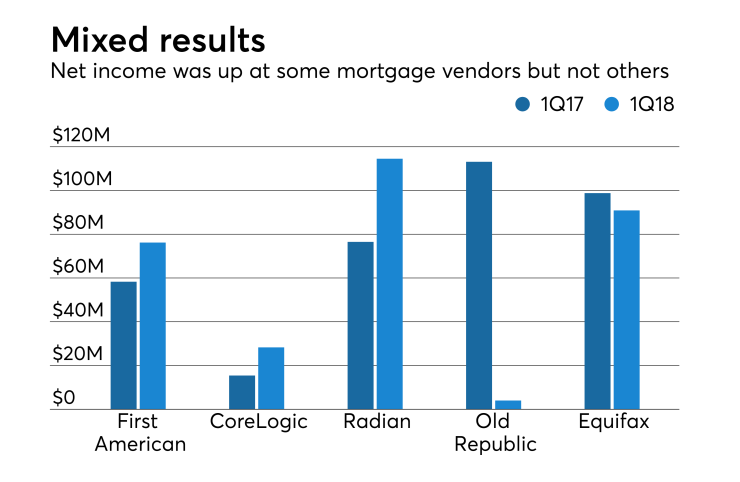

Among the companies that generated a year-to-year quarterly net-income gain despite the slump in mortgage origination volume was First American Financial Corp. which earned more than $76 million in net income, up from more than $58 million.

"Revenue growth in our purchase and commercial businesses largely offset the impact of the downward trend in refinance transactions," said First American CEO Dennis J. Gilmore in a press release.

CoreLogic's net income rose to more than $28 million from more than $15 million.

"We continued to outperform the U.S. mortgage market volume trends and expand our footprint in areas such as property insights, international, insurance and spatial solutions and valuations,” said CoreLogic President and CEO Frank Martell in a press release.

Radian Group Inc. earned more than $114 million, up from more than $76 million.

The company during the quarter had "lower mortgage insurance loss provisions, as well as good expense control and investment income," according to a report by analysts Randy Binner and Ryan Aceto at investment bank B. Riley FBR Inc.

"Premium production was lower than anticipated, but new insurance written and insurance in force was ahead of our expectations," they said. "We maintain our Neutral rating, based on relatively better capital positions and growth opportunities than what we see for other MI writers."

Mortgage industry vendors that recorded year-to-year quarterly declines in net income included Old Republic International Corp., which saw its net income drop to $4 million from more than $113 million.

Old Republic experienced a relatively small decline in title insurance revenues to a little less than $524 million from almost $528 million, but the company during the quarter also was contending with tax and accounting changes and the continued runoff of its mortgage insurance unit.

"Two significant events have occurred that have a bearing on the reporting of consolidated pretax income, as well as post-tax net operating and net income," according to a company press release.

"The first arises from a new rule of the Financial Accounting Standards Board which requires the inclusion of unrealized investment gains or losses emanating from changes in the fair value of equity (but not fixed maturity) securities in the determination of pre and post-tax net income.

"The second emanates from a reduction of nominal federal corporate income tax rates from 35% to 21%."

Equifax's overall net income of $90.9 million was down almost 42% despite an 8% increase in mortgage revenues to $41.7 million.

"During the quarter, we invested significantly in data security and IT infrastructure enhancements, and also took strong steps towards rebuilding the trust and confidence with consumers, customers and partners," said CEO Mark Begor in a press release, referencing a major data breach the company

"Our first quarter results are a strong step forward but we still have work to do to improve our infrastructure and regain the trust of our customers, partners, and consumers," he said.