Among four of the most prevalent consumer lending products, personal loans tend to get paid first over mortgages, auto loans and credit cards, TransUnion found in a study released Wednesday.

The finding came as a surprise, according to Ezra Becker, senior vice president and head of research for TransUnion's financial services business unit.

"We just kind of assumed personal loans would be in last place, but they weren't," he said.

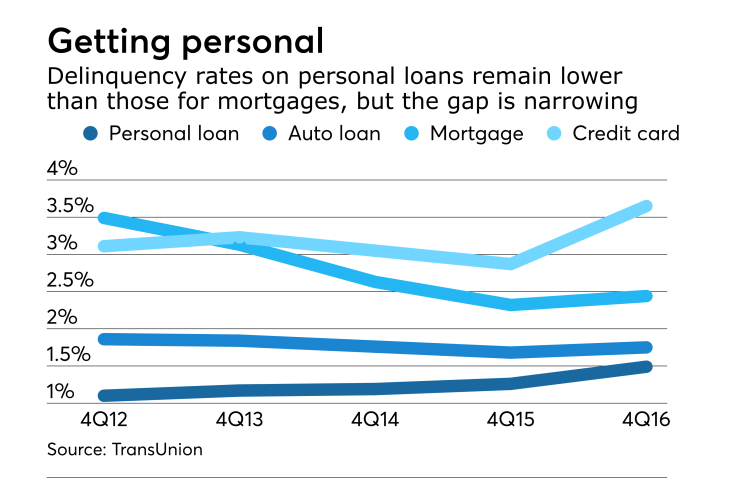

The percentage of personal loans that were delinquent after a year for borrowers who had a personal loan, an auto loan, a mortgage and a credit card was lower for personal loans than for the other three other types of debt.

The study marks the first time TransUnion has examined personal loan data in its payment hierarchy research, so the trend may not be new, but it is coming to light as credit reporting agencies conduct deeper analyses of consumer credit. The findings have growing importance for mortgage and other lenders.

For example, the government-sponsored enterprise Fannie Mae began requiring mortgage lenders to submit more in-depth consumer credit data

Borrowers with personal loans may often not have a home mortgage and not perform as well as a mortgage borrower, because mortgage underwriting focuses more on prime credit and personal loans are more apt to be taken out by someone whose credit is nonprime, said Becker.

But there clearly is some overlap that this deeper analysis of credit data has shown at a time when personal loans have a higher profile in the market.

Personal loans have been more popular recently due to growth over time in financial technology platforms that offer them; but TransUnion's analysis to date suggests it is not increased popularity that has driven consumers to pay these loans first.

Although the motivations behind the priority consumers put on personal loan and other payments bear further study, researchers' best guess is that consumers tend to pay off personal loans first because they are shorter-term and can be paid more quickly than other debts.

" 'I'm just going to pay it and get it out of the way' — there is some element of that," Becker said.

The study's release came a day after TransUnion began selling new analytics that afford mortgage lenders and others more opportunity to do their own, more granular analyses of aggregated, anonymous credit data that users can use to benchmark their companies' performance.

Credit reporting agencies and companies financing mortgages and other forms of consumer debt have been doing more to analyze credit since the Great Recession, when several historical assumptions about credit were overturned. The belief that people always pay their mortgages first was one of these.

TransUnion's data analysts have unearthed a couple of other exceptions to that rule over time.

Most notably, it discovered that during the recession, people took to paying off their credit cards before their mortgages instead of paying their mortgages first because they needed the immediate access to cash. That trend later reversed as the market normalized.

TransUnion added auto loan data to its analysis after that and discovered that consumers consistently paid off their auto loans before their mortgages or their credit cards, possibly also in part because that loan is shorter-term than a mortgage.