With spiking unemployment and financial uncertainty looming, home prices are expected to grow at half the rate that was projected before the COVID-19 outbreak, according to Veros Real Estate Solutions.

Among the 100 largest housing markets in the country, Veros expects a 1.9% average annual appreciation rate through the first quarter of 2021. In early March, the real estate valuator projected a rate of 3.9% through the end of 2020, given that housing appreciation

"The combination of all of these factors results in mild forecast depreciation on average for the next quarter with a return to normal appreciation rates later in the year and into 2021," Eric Fox, vice president of statistical and economic modeling at Veros, said in a press release.

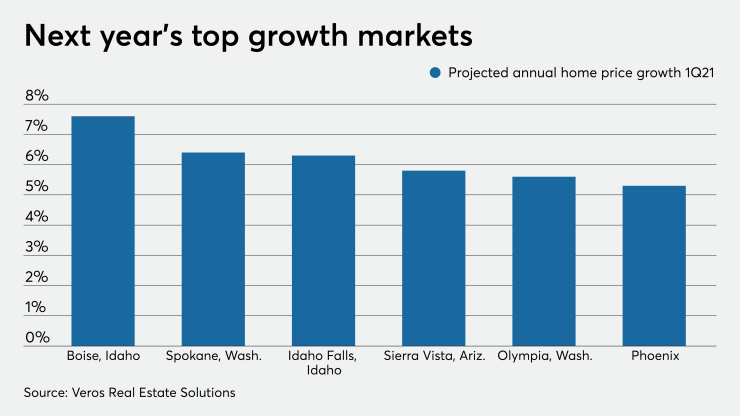

The markets with the strongest forecasts all reside in the western half of the U.S. The report predicts that Boise, Idaho, will see a 7.6% year-over-year price appreciation in the first quarter of 2021. Spokane, Wash., follows at 6.4% as well as 6.3% for Idaho Falls, Idaho, and 5.8% in Sierra Vista, Ariz.

Conversely, Veros expects home prices in Baton Rouge, La., and Chicago to both fall 2.3%, with Bridgeport, Conn., and Champaign, Ill., each dropping 1.5%. About a tenth of all markets should anticipate annual depreciating values, up from just 1% in the first quarter of 2020.

Since housing wasn't

"Home price trends and forecasts certainly take a backseat to more pressing health and safety issues during this unprecedented tragedy," said Darius Bozorgi, CEO of Veros Real Estate Solutions.

"While we expect a softening of house prices in the near-term, we anticipate a rebound when