Sexual harassment in housing finance has been drastically underreported.

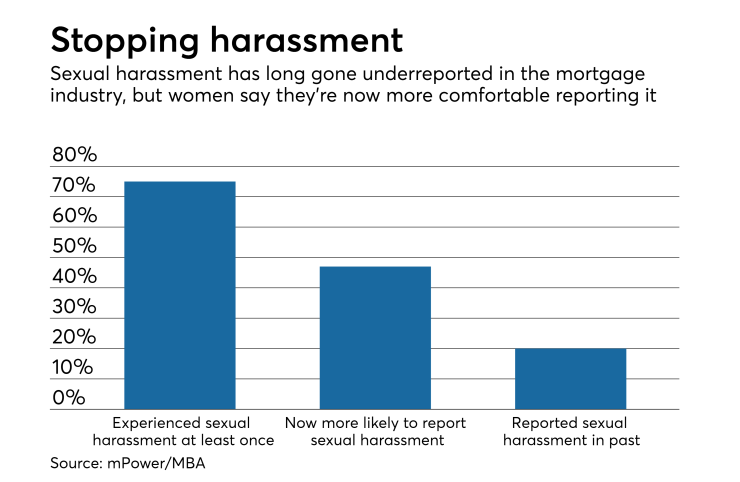

More than 70% of women in the industry indicated they have had at least one experience that met the Equal Employment Opportunity Commission's definition of sexual harassment, but only about 20% told someone in the chain of command about it, according to a survey by mPower, the Mortgage Bankers Association's professional networking group for women.

"You'll see other surveys, some have higher percentages, and some have lower percentages, but I do think the trend of women feeling comfortable and safe to report is one that is pretty consistently low," said Mortgage Bankers Association Chief Operating Officer Marcia Davies.

That may be about to change, she added.

Increased public discussion about sexual harassment in the wake of multiple allegations against Hollywood producer Harvey Weinstein, as well as incidents involving

And more executives in the industry are looking for ways to proactively address the problem.

For example, mPower member FormFree Holdings Chief Operating Officer Claire Weber, recently stepped in when she saw an unnamed executive having what she described as an inappropriate interaction with a new employee.

When the interaction occurred, Weber interrupted it, politely separated the two people, and offered to talk over what happened with her employee, according to an opinion piece that appeared in an

She would like to be able to head such incidents off entirely before they occur in the future.

"Rather than spending time and mental energy that I could be using to further the goals of my company and this industry to learn how to 'handle it' better, I wish I knew how to stop it," she said.

Davies hopes Weber's account and the survey will lead to broader industry discussion that will help prevent more sexual harassment in mortgage banking.

The survey was sent to 2,000 mPower members and had a 13.5% response rate. Nearly 90% of respondents who have experienced sexual harassment said it happened while they were in their twenties, and 56% said an incident occurred in their thirties.

While mPower surveyed only women, who have been more vocal about the topic, a small number of men also have alleged harassment in Hollywood in the wake of the Weinstein allegations, Davies noted.

"I think what we're trying to do is have a conversation and through that conversation and dialogue, find ways to have the tools to handle [sexual harassment], but also raise awareness among men and women in our industry of appropriate workplace behavior and make sure that we are all working together to make sure that this topic doesn't continue to be such an issue," said Davies.

Activities the EEOC defines as sexual harassment include inappropriate comments, which were the most common complaint in the mPower survey. The majority of respondents also complained of inappropriate touching, and just under half reported unwanted sexual advances.