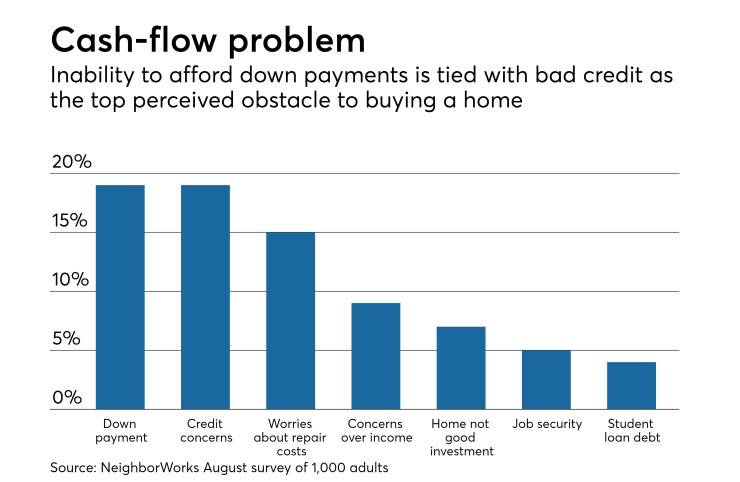

This Vermont housing group had a problem: Many prospective homebuyers in its region could afford a monthly mortgage payment, but they lacked the down payment. So the nonprofit NeighborWorks of Western Vermont approached TD Bank with an idea: Lend it the money to fund a program that helps creditworthy borrowers come up with down payments to buy homes.

TD Bank gets repaid in 10 years for the $3.5 million credit line it extended for the program. It also gets to expand an already existing relationship with the nonprofit, adds to its book of affordable housing deals and receives Community Reinvestment Act credit. In all, NeighborWorks anticipates the financing will help it provide down-payment assistance to roughly 100 borrowers.

The need for low-interest loans or grants to cover down payments is great. Gregg Gerken, TD Bank’s head of commercial real estate and one of its point people on affordable housing, underlined the mounting concerns about whether service workers, teachers and first responders can afford to live in the cities in which they work.

“In most urban areas, the answer is no,” he said. “When we look at the demographic trends and the supply and demand equation, we feel that this is a very good place with a very large need, and that makes for a safe loan equation.”

As would-be buyers fret, more banks are working with nonprofits and state housing agencies to help get them into the purchase market. Banks receive CRA credit either by lending or donating to these programs, but they also get to meet potential borrowers at a time when rising interest rates are dampening mortgage origination activity.

Down-payment assistance programs have been around for some time and have taken many forms, but cooperation between banks and nonprofit or state agencies is a newer phenomenon, said Corey Carlisle, executive director of the American Bankers Association Foundation. Those organizations can be especially helpful in getting creditworthy borrowers ready for a mortgage.

“They are close to the consumer, they have the ability to work with consumers on counseling, and they can cultivate a borrower that’s going to be ready for homeownership that can then take advantage of the loan,” Carlisle said. “It’s exciting. There are a lot of different types of models out there now.”

One prominent example affordable housing advocates like to point out is Wells Fargo’s NeighborhoodLIFT program, in which the bank has committed $412 million in grant money to NeighborWorks since 2012. That cash funds homebuyer education programs and down-payment-assistance grants across 64 markets nationwide.

To date, Wells Fargo estimates that its contributions have provided down-payment assistance grants to more than 18,600 homebuyers, said Kimberly Smith-Moore, Wells Fargo’s national program manager for NeighborhoodLIFT. Most recently, Wells Fargo and NeighborWorks expanded the program to Mississippi.

“We’ve been through the financial crisis, but I really look at it as more of an affordability crisis right now because homes are not affordable to low- to moderate-income individuals,” she said. “There are a lot of customers that I speak with that if they didn’t have the down-payment assistance, they couldn’t afford the home. It really makes homeownership more affordable.”

The money Wells Fargo provides to the program is in the form of philanthropic grants, but there is a business case to be made as well. In addition to CRA credit, the bank gets to meet potential borrowers at the two-day launch events it hosts with NeighborWorks in each market it enters through the program. As the only lender there, it has picked up a good chunk of mortgage business this way.

However, there is no requirement that recipients of the down-payment assistance take out a mortgage with Wells Fargo, Smith-Moore said.

Though Wells Fargo can cut a big check for the cause, other banks have also figured out creative ways to finance down-payment assistance programs on a smaller scale.

For example, the $5.8 billion-asset Woodforest National Bank in The Woodlands, Texas, recently entered into a $12 million syndicated loan agreement, along with Hancock Whitney and Tolleson Private Bank, with the Texas Department of Housing and Community Affairs. The state agency will use that money to finance down-payment assistance loans and closing-cost assistance for mostly low- or moderate-income first-time homebuyers through its My First Texas Home program.

Woodforest had previously loaned $10 million to the state agency for down-payment assistance. That cash was deployed in about six months and ultimately funded zero-percent down-payment assistance for more than 1,500 homebuyers, with hundreds more still on the waiting list. That level of demand led Woodforest to invite other lenders to join it on the more recent round of funding.

Woodforest received accolades from both the American Bankers Association and the Texas Bankers Association, even though Woodforest is not a traditional mortgage lender itself.

NeighborWorks of Western Vermont’s down-payment assistance program offers up to $40,000 for a second mortgage loan to put toward a down payment. The nonprofit charges an interest rate of 2% above the rate on the first mortgage for a term of 15 years.

Although the credit line is a little bit unusual for TD Bank, the bank has been involved in other kinds of financing deals. Last year, for example, it closed on a $50 million bond for the Connecticut Housing Finance Authority to fund around 300 mortgages for low- to moderate-income borrowers.

Affordable housing advocates say that sometimes bankers have misconceptions about what it means to work with nonprofits, thinking that other lenders will slow down the underwriting process.

But Carlisle said that many nonprofits are sophisticated lenders, and they frequently employ ex-bankers. Often when banks and nonprofits work together, any preconceived ideas they might have had about each other evaporate quickly.

“With their ability to blend lots of different subsidies and their closeness to the borrower and the community, it works out really well and saves the bank from creating a specialized lending unit,” Carlisle said.