Until recently, BMO Harris customers who were seeking a home equity loan or line of credit could apply online and sign most of their documents through an online portal. But they couldn’t escape coming face-to-face with a notary to sign their promissory note and deed, whether that meant visiting their branch’s drive-through or requesting a notary meet them at their home.

Tom Parrish, head of retail lending product management at BMO Harris Bank, even set up a table in his driveway when he needed the services of a notary to wrap up his recent mortgage refinance but wanted to maintain social distancing amid the coronavirus pandemic. Parrish and his wife took turns completing their steps while keeping apart from the notary.

Now customers of the Chicago bank have a third option: getting their documents notarized remotely with a notary on screen.

On May 12, BMO Harris closed its first home equity line of credit remotely from start to finish using Blend Close, the digital closing product created by the consumer lending platform Blend. The $138 billion-asset bank is one financial institution inching toward remote online notarization, or RON, by starting with home equity loans and lines of credit. Unlike electronic notarization, where the notary is signing documents on a computer but sitting face-to-face with the consumer, with RON the entire notarization process is conducted remotely via audiovisual technology, typically a webcam.

According to vendors and consultants, more financial institutions are interested in turning notarization into an all-digital experience. In the short term, this will benefit customers who are hesitant about interacting with a notary in person during the pandemic. In the long term, proponents argue it will be a more efficient method of notarization. But because there are several obstacles, it will be a while before RON is widely accepted, especially for closing mortgages.

“The providers are there, waiting for more and more people to be able to conduct business that way,” said Craig Hughes, managing director of financial services at CC Pace, a consulting firm. “There is not a lack of technical solutions to the problem. This is more of a legislative issue.”

Hurdles to going remote

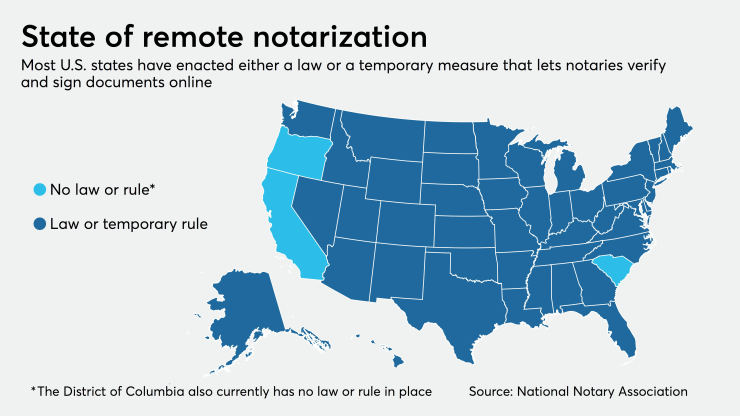

According to the National Notary Association, 24 states have passed permanent RON laws that let a signer interact with a notary using audiovisual equipment, while 14 of those states have fully implemented their RON procedures, meaning the laws are in effect and notaries are authorized to perform their duties remotely. Many other states, including New York, have issued temporary authorizations allowing notaries to perform RONs or other forms of remote notarization during the pandemic.

But even in states where RON is legal, laws may differ in individual counties.

Moreover, there are other obstacles to remote notarization, such as acceptance. For instance, mortgages are one of the main drivers in expanding the use of RON. But some participants in the mortgage supply chain have yet to embrace the concept.

“Just because lenders can do RON legally in 24 states today doesn’t mean their investors will buy those loans or the warehouse lenders will let those lenders fund the loans,” said Julian Hebron, founder of The Basis Point, a sales and strategy consultancy for consumer finance and fintech companies. “Most title companies might choose not to take the title insurance risk, especially in cases where temporary measures have gone in.”

On March 18, Sens. Kevin Cramer, R-N.D., and Mark Warner, D-Va., introduced the Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020, permitting the immediate use of remote online notarization across the U.S.

But absent federal regulations, lenders and title companies may still be wary.

Technical issues also persist.

“There are a whole set of standards that go into making RON technologically sound,” said Hebron. “The notary could turn on Zoom but maybe forget to press record. You could hold up your driver’s license to the webcam and they can validate it, but that technically means they are notarizing it after the fact, which is not something a title company would feel comfortable insuring.”

A more widespread compromise today, and even before the pandemic, is the hybrid closing. In this scenario, non-notary documents are signed electronically, but a notary meets with the borrower in person on the same day to sign the rest on paper.

RON in action

Vendors including Blend, LenderClose, Notarize, Safedocs and SIGNiX all have clients in financial services and facilitate RON in some form.

For example, Blend provides both hybrid and fully remote closings on its new Blend Close platform, which can be used for mortgages, home equity loans and lines of credit and eventually for other consumer banking products.

Borrowers get access to a portal, where they can select the type of closing they want (fully remote or hybrid) and choose their preferred blocks of time for the closing ceremony. Ahead of the closing ceremony, borrowers can preview all documents in their closing package and scan key details marked by the lender.

If borrowers have questions, they can initiate a co-pilot session, which sends a notification to their loan officer that they need help, and the loan officer will work through questions with them through screen sharing. For the RON scenario, the borrower will electronically summon a notary on the day of closing to sign the final set of documents by webcam.

BMO Harris, the first bank to use Blend Close for RON, decided to test the waters with home equity products, rather than mortgages. The institution plans to roll it out with mortgage refinancing in June, but does not yet have a target launch date for mortgages.

Parrish said the bank decided to start with home equity for a few reasons.

“The closing process is directly owned by us, whereas mortgages require coordination with the title company,” he said. “The closing documents are significantly less, making it easier and faster to close digitally. And home equity is a portfolio product and does not have the electronic closing requirements that a mortgage does to properly close and sell an eNote," or electronic promissory note.

Besides BMO Harris, Blend has publicly announced that it is in talks with U.S. Bank, a current Blend customer, to use its Blend Close platform as well.

LenderClose, a lending platform provider based in Des Moines, started executing RONs after the governor of Iowa temporarily suspended the requirement for a notary to sign real estate loan documents in person on March 22. Lenders can use their own online notary publics or choose from those in LenderClose’s pool.

The fintech closed a mortgage loan with a member of Cedar Rapids-based Collins Community Credit Union, and is working with a number of other credit unions in the state to facilitate HELOCs and refinance loans.

Beyond real estate, banks and credit unions find RON useful for other purposes. Notarize, an online notary service, said that its financial clients use RON for auto financing and lending, private wealth management and personal loans.

SIGNiX, a digital signature company, has about 100 banks and credit unions as clients. About a dozen have signed up to use its RON solution, said Pem Guerry, executive vice president of SIGNiX.

“I believe RON has more security and more anti-fraud capabilities than doing it in person,” said Guerry. “You’ve got technology to analyze whether the driver’s license is legitimate. You cannot change a document after it’s been notarized, unlike the paper world. People were too nervous about identity authentication. But I think [the pandemic] got a lot of people over their fear because they had no choice.”

The video banking platform POPi/o is working on its own RON product, which it hopes to release in the fourth quarter of 2020. The platform already supports a number of requirements that go into RON, including recording and retaining a video session with the signer and any witnesses, and the ability for a consumer to upload documents to be signed or notarized.

Gene Pranger, CEO and founder of POPi/o, said that four or five customers have expressed interest in the platform’s RON services, but he expects that number to grow.

“As state notary laws continue to evolve, we foresee that RON will become the most efficient and consumer-preferred method for completing all notary-related functions,” said Pranger. “We don’t see the easing of pandemic concerns erasing consumer expectations once RON becomes an accepted method to legally verify transactions.”

Parrish also says RON is here to stay. Already, 60% of BMO’s customers who use Blend are completing their home equity and mortgage applications outside of business hours.

“With the pandemic, folks are more comfortable using video and being able to close this way,” he said. “If you can make a convenient option for the customer, why wouldn’t you want to take advantage of it?”