-

Mortgage rates edged higher after the Fed held rates steady, with markets weighing political shifts, Treasury moves and mixed signals on where borrowing costs head next.

February 5 -

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

January 30 -

Competition that impacted margins and prepayments in excess of expectations were challenges during the period, but executives report first quarter improvement.

January 29 -

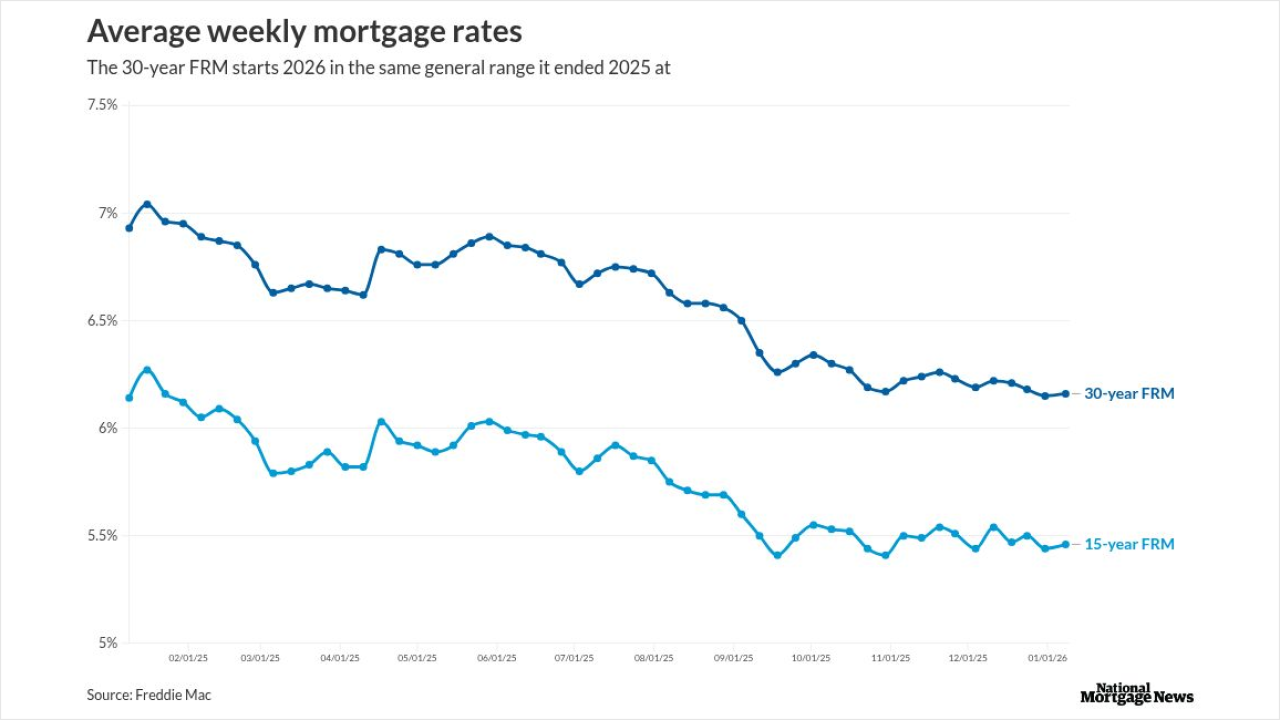

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

January 28 -

The contract rate on a 30-year mortgage rose 8 basis points to 6.24% in the week ended Jan. 23, according to Mortgage Bankers Association data released Wednesday.

January 28 -

Treasury moves look less about data or auctions and more about gaps and channels, with PMI next to decide direction, according to the CEO of IF Securities.

January 23 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

The 30-year fixed rate mortgage increased 3 basis points this past week, off of a three-year low point, but are nearly a percentage point lower than a year ago.

January 22 -

Markets brushed off mixed, stale data as tariff news sparked a brief rally, but open Treasury gaps kept bond signals cautious, according to the CEO of IF Securities.

January 22 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

Treasuries sold off sharply after reports Danish pension funds are exiting, steepening the yield curve as stocks fell and gold surged, according to the CEO of IF Securities.

January 20 AD Mortgage and IF Securities

AD Mortgage and IF Securities -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

The contract rate on a 30-year mortgage dropped 7 basis points to 6.18% in the week ended Jan. 9, according to Mortgage Bankers Association data released Wednesday.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

US mortgage rates fell last week to the lowest level since September 2024, a hopeful sign for the sluggish housing market to start the new year.

January 7 -

Late last year, commercial bank holdings of mortgage paper reached the highest level since 2023 as these depositories are flush with deposits.

January 6