-

The FHFA chief told Fox an offering could be done near term - but may not be - while a Treasury official addressed conservatorship questions at an FSOC hearing.

February 6 -

Rising defaults, fraud risks, and collapsing rents are converging in urban multifamily, threatening lenders and taxpayers, according to the Chairman of Whalen Global Advisors.

February 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The documents that the Housing Policy Council obtained from FHFA show past debate over one newer score and concerns about a single report with redacted context.

February 5 -

Home equity investment platforms continue to attract dollars from the venture capital community but also face a proposed de facto ban in one state.

February 4 -

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

February 4 -

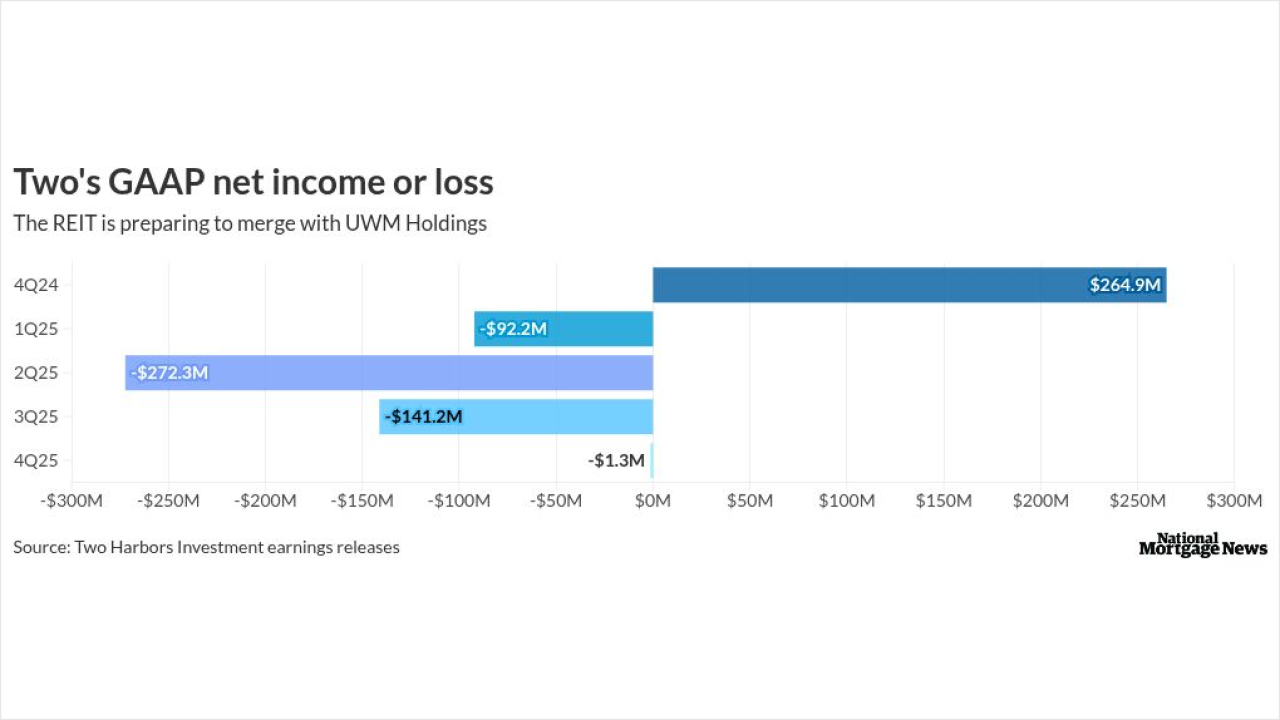

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

February 3 -

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

February 2 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

The government mortgage securitization guarantor flagged the goal back during the first Trump administration, warning then that it would be a long-term project.

January 26 -

On Jan. 26, use of the new Uniform Residential Appraisal Report shifts from limited production to the optional phase, giving lenders 10 months to get ready.

January 26 -

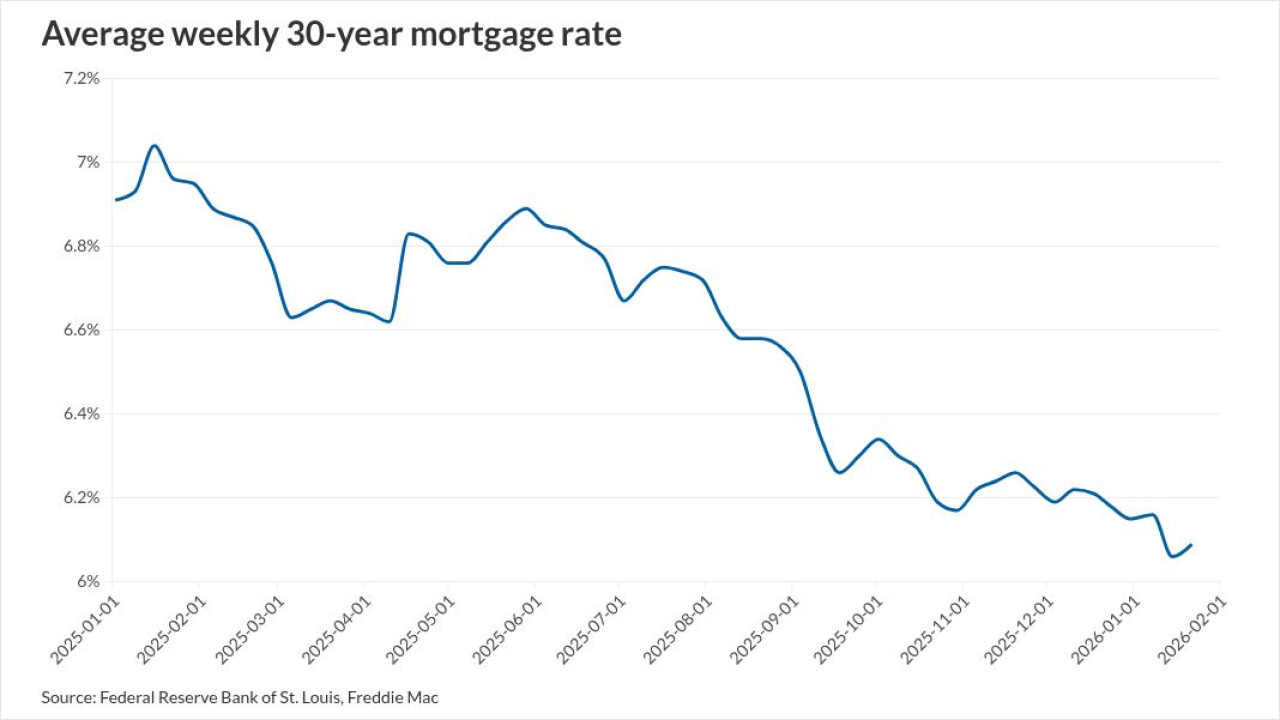

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

Reducing agency loan pricing adjustments and credit reports may help, a trio of industry groups wrote in a letter to the National Economic Council's director.

January 22 -

The President is promising big announcements on housing affordability issues in Switzerland, but will it include ending the GSE conservatorships?

January 20 -

What's said in the online video, which replicates the president's voice with his permission, may be as important to lenders as how the message is delivered.

January 20 -

Hot securitization sectors such as non-qualified mortgages and home equity are set to expand further amid market shifts this year, recent forecasts suggest.

January 20 -

Freddie Mac's investment in affordable housing increased by 17% in 2025 compared with the year prior, the government-sponsored entity said.

January 16 -

A Community Home Lenders of America adds arguments against use of single bureau while another paper takes the position that the idea merits further study.

January 16 -

The government securitization guarantor could move forward with more big-picture initiatives as well this year now that it officially has a confirmed president.

January 15 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9