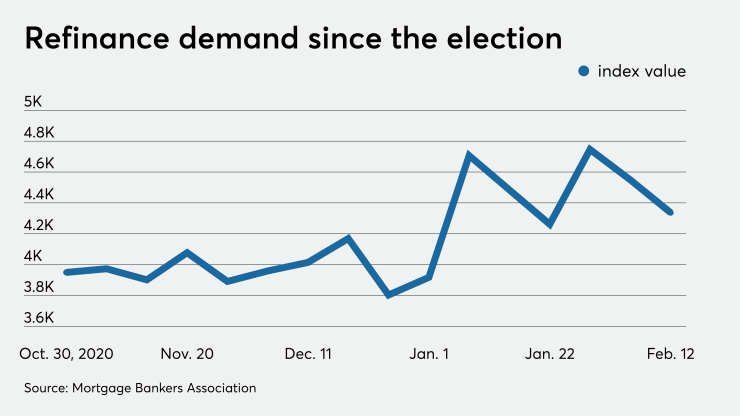

The share of mortgage applications taken out to refinance an existing loan slipped as rates climbed to a high not seen since November, according to the Mortgage Bankers Association.

The dip in refis during the week ending Feb. 12 brought their share below 70% for the first time since October, the trade group found. The refi share during the latest week tracked by the MBA was 69.3%, down from 70.2%

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive but constrained by inventory shortages.

“The uptick in rates has slightly dampened refinance activity, with MBA’s index falling for the second week in a row,” said Joel Kan, MBA’s associate vice president of economic and Industry forecasting.

While both refis and seasonally adjusted purchase apps were lower week-over-week by 5% and 6%, respectively, both parts of the market looked a lot better than they did during the same week last year. Refis were up 51% from a year ago and purchases were up 15%.

In total, applications were down a little over 5% on a seasonally adjusted basis.

A drop in government applications drove an increase in the average size for a loan to a new survey-high because it meant there were fewer small Federal Housing Administration-insured loans in the mix. The FHA loan share was 9%, down from 9.5% the previous week.

The average loan size was $412,200, as compared to $402,200 the previous week.