Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial and make other strategic acquisitions.

Nationstar's corporate parent generated a net loss of $64 million in July under generally accepted accounting principles. GAAP net income in the next two months after the Washington Mutual shell company acquired Nationstar totaled more than $1 billion for the combined company.

In comparison, Nationstar Mortgage Holdings posted $7 million in net income during

Mr. Cooper also noted in its most recent earnings that it is planning to buy Pacific Union Financial, and will be considering other transactions.

However, Mr. Cooper is "going to be pretty selective" about future acquisitions, Chairman and CEO Jay Bray said during the company's earnings call.

Mr. Cooper did not disclose the purchase price for Pacific Union Financial, but did note that the deal will allow Mr. Cooper to grow its $514 billion servicing portfolio by $25 billion or nearly 5% if it receives required regulatory approvals. The company estimates the transaction will closes in 2019's first quarter.

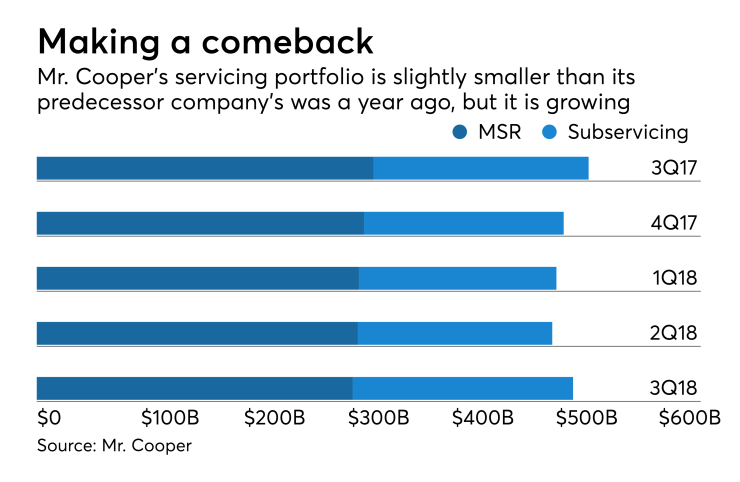

In the meantime, Mr. Cooper has been positioning itself as a low-cost provider and increasing its 2018 servicing portfolio through other sources.

"We believe no company has done more transfers than we have," Bray said.

Mr. Cooper expects its combined servicing and subservicing portfolio to grow to $535 billion by year-end.

During the third quarter of 2018, the company's servicing portfolio had an unpaid principal balance of $514 billion. In the third quarter a year ago, Nationstar's servicing portfolio totaled $533 million.