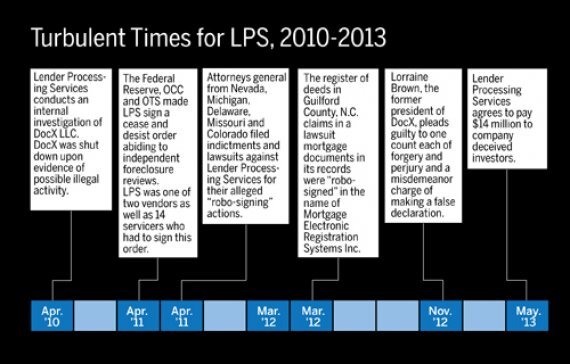

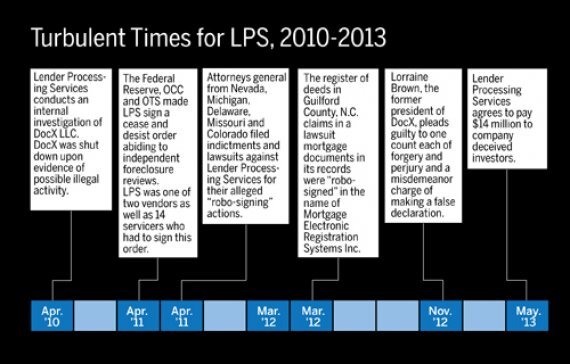

Closed for Business

Signing the Dotted Line

State AG's Fight LPS

Robo-Signing Lawsuits Plague Vendor

No Stopping the Robot

Time to Pay Up

The Housing for the 21st Century Act includes provisions covering policy, manufactured homes and rural infrastructure introduced in a prior Senate proposal.

Mortgage loan officer licensing saw its first rise since 2022 as Fannie Mae projects $2.4T in 2026 volume. Experts eye a market reset amid improving affordability.

The secondary market regulator will formally publish its own rule on Feb. 6, after a comment period and without making changes to what it proposed in July.

The FHFA chief told Fox an offering could be done near term - but may not be - while a Treasury official addressed conservatorship questions at an FSOC hearing.

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.